Tempur-Pedic ($TPX) looks like a buy – both as a stock and as a mattress. $TPX has traded in a highly predictable manner within a clearly established range since March…and looks poised for another bounce!

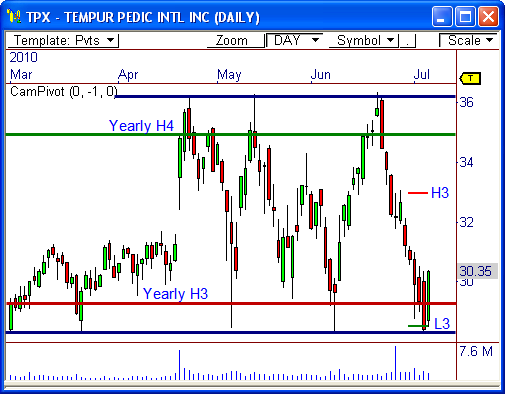

The daily chart of $TPX shows price has traded in a well-defined trading range from $28.25 to $36.30 the last four months, with six total passes during this period of time.

The fact that $TPX is beginning to show signs of strength off support yet again. This, coupled with major forms of pivot confluence, indicates we could see another rally back toward $36, with a pit stop at $33.

$TPX is bouncing off multiple timeframe pivot-based support, with the monthly L3 Camarilla level at $28.50 and the yearly H3 Cam level at $29.28. Combining these two pivot levels with critical support at $28.50 makes a strong case for responsive buying participation.

If you want a refresher on the Camarilla Equation, Read This.

As long as price remains above $28.50, $TPX has a shot to rally back to the $34.90-$36.00 band of resistance, since there is also monthly and yearly Camarilla-based resistance up top.

The predictability of $TPX over the last four months has been so clear, that even the most anxious traders have slept like babies while trading this stock.

Let’s see if this holds true!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss