Obviously, the first Friday of the month brings the Non-Farm Payroll number front and center. The market has been winding up for four days ahead of this key figure. The good news for us? It doesn’t matter what the number reveals, because a breakout in either direction could mean a 200 point move for the Dow.

Tight Range

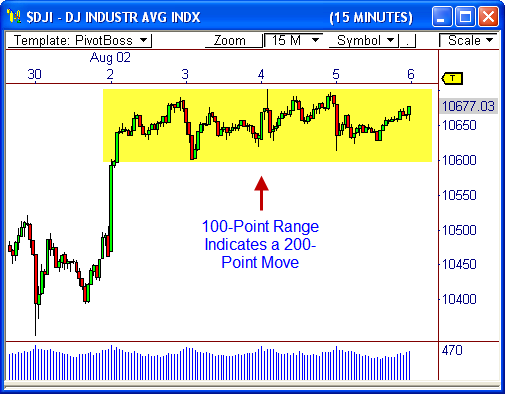

The 15-minute chart shows the Dow Jones Industrial Average ($DJI) has been coiling within a meager 100-point range for the better part of the last four sessions.

A confirmed breakout through either 10,600 or 10,700 could mean a quick 200 point move in the direction of the break – so watch this range closely.

The fact that price has been holding above the important 10,600 fulcrum level bodes well for the bulls, but a violation also leaves “clear air” down to 10,400.

An opening print that occurs beyond range and value could be the ticket to a great trending day – or at least a trending morning!

PEMA Support

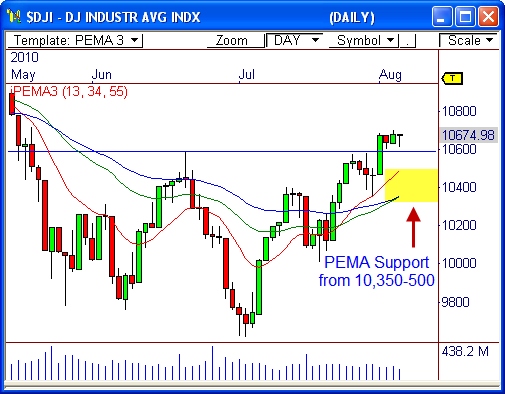

Since the Dow has enjoyed a bullish advance over the last five weeks, we could see an initial downside break that leads to a very nice buying opportunity within the current framework of the uptrend.

As a matter of fact, the Dow now have multiple moving average support beneath price, which helped us forecast a nice buying opportunity last Friday.

Any pull-back to these averages could lead to a very nice PEMA Pull-Back buying opportunity – a setup explained in my FREE eBook. Therefore, we should still see buying interest between 10,350 and 10,500 should a downside break from the four-day range occur.

Let’s see what happens!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss