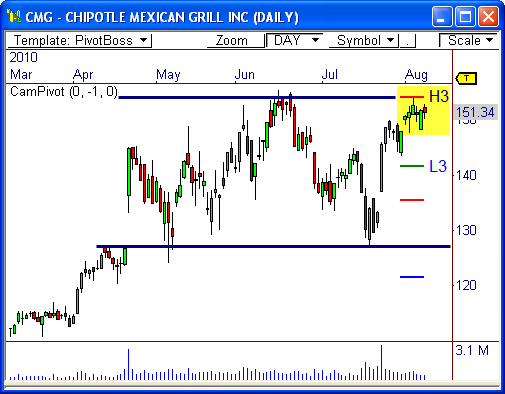

Chipotle Mexican Grill ($CMG) has been an active mover for some time, most recently rallying from $127 to $154. However, bullish momentum seems to have dissipated at major resistance, which could spark another key sell-off in this stock. Here’s why..

Confluence of Resistance

The daily chart of $CMG shows price has stalled at a clear area of resistance over the last week of trading. This band of resistance stretches from $154 to $155.50 and includes visual resistance and the H3 Camarilla pivot level.

Since price was rejected in this area in June, thereby paving the way for a sell-off back to $127, we could see the same type of reaction in this area soon.

If price cannot rise above $155.50, look for a potential sell-off back toward the bottom of the large trading at $127, with intermediate stops at L3 ($141.70) and L4 ($135.40).

A push below $148 could trigger selling pressure.

To read more about the Camarilla Equation, CLICK HERE.

PEMA Breakout

The 15-minute timeframe shows price is clearly coiling ahead of a major breakout opportunity. A triangle pattern has formed, which has a back end of about 6 points, which means a breakout could lead to a six point move from this pattern alone.

Also, the pivot-based multiple moving averages show the PEMA Breakout setup is brewing. As you recall, this setup usually precedes a major breakout opportunity.

Watch $150 for an early downside break, and $153 for another test at resistance.

To read more about the PEMA Breakout setup, CLICK HERE.

Since price is holding at a significant area in the daily chart, and is clearly winding up in a lower timeframe, we could see big price movement out of this stock soonishly. Watch $150 for early weakness, and $148 for confirmed weakness.

Let’s see what happens!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss