Genesee & Wyoming, Inc. ($GWR) has been testing major areas of price interest the last two months. I’ve got three reasons why this stock could be ready to sell off..

1. Double Pivot Hot Zone

The daily chart of $GWR shows price has been testing clear visual resistance at $42.70 since the beginning of August. However, there is also double-pivot confluence at this zone, as well, which spans from $42.40 to $42.65 (Floors and Cams).

Price has been testing this zone for two months, without a true breakout. This could lead to key weakness ahead, likely back toward $39.25, and then back to the bottom of the range at around $36.25.

2. Outside Reversal Signal

Yesterday’s candlestick also shows the formation of a bearish Outside Reversal pattern, which occurs when yesterday’s high price is higher than the prior day’s high, and the close is lower than the prior day’s low.

When this pattern occurs at resistance, something interesting is occurring. Basically, the market is testing price levels beyond resistance in order to gauge buying interest. If initiative buyers do not enter the market, a reversal usually occurs.

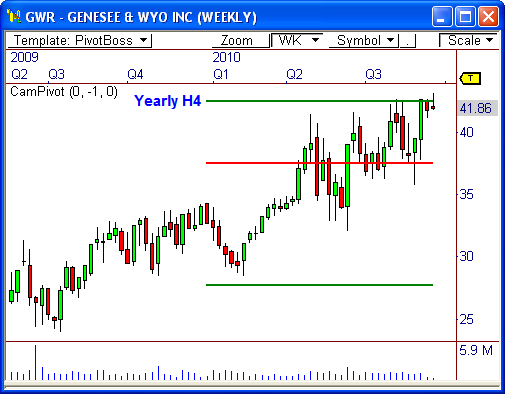

3. Yearly Pivot Resistance

The weekly chart shows that price has stalled at the yearly H4 Camarilla pivot level, which could be a major turning point in this stock.

We still have 3 days left in this week’s trading action, so the current weekly bar candlestick could still change for the better. However, as of right now, this is a bearish indication that could push price back toward the yearly H3 pivot at $37.55.

Let’s see how this one plays out!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss