The E-Mini NASDAQ 100 futures contract (NQZ0) has endured its largest retracement of the last three months. However, more selling pressure could be seen back toward the 2,060 level. A breakout from yesterday’s range could spark the next key breakout move in this contract. Take a look..

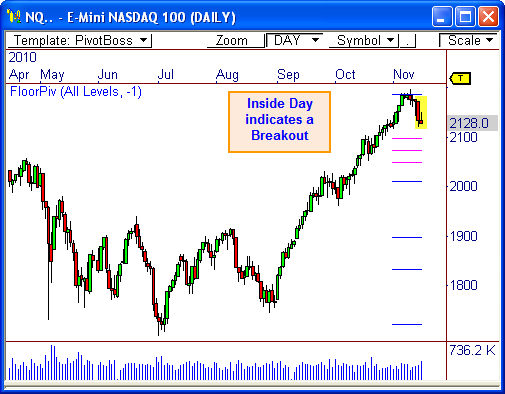

Inside Day

The daily chart shows price has reacted off the monthly R1 resistance level and is headed back toward the monthly pivot range, which spans from 2,049 to 2,098. This retracement has been the largest in the last two months, but more selling could be seen ahead due to the recent development of the Inside Day relationship, which occurs when yesterday’s price range is inside the price range from two days ago.

A breakout from yesterday’s range (2,126.50 to 2,151) could offer an excellent Trend Day opportunity back toward the meat of the central pivot range (2,060-ish).

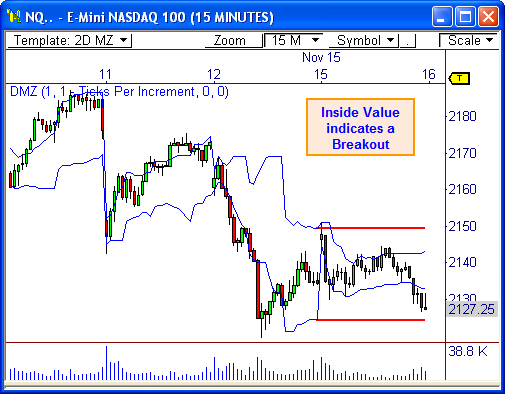

Inside Value

The 15-Minute chart also shows price has formed an Inside Value Relationship, whereby today’s Value Area is inside the Value Area from yesterday’s market. This relationship usually indicates a breakout in price, so look for breakout confirmation outside the confines of yesterday’s price range.

Keep in mind, the market remains longer term bullish, especially if price remains above the monthly S1 and bottom central pivots. That is, any pull-back to these zones would still be seen as buying opportunties.

Let’s see how this plays out!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss

Pingback: Big Day for the Dow? | PivotBoss.com