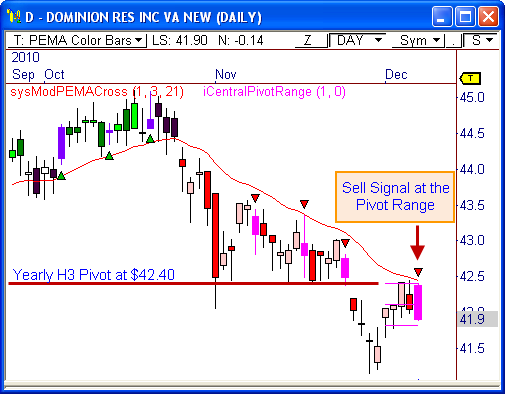

With the major market indexes testing clear-cut resistance levels, it may be time to turn our attention to short term selling opportunities. Dominion Resources, Inc. ($D) has been trending quietly lower the last six weeks and is beginning to show early signs of weakness, which could yield short term profits! Check it out..

Sell Signal

The Modified PEMA Crossover system has fired a new Short opportunity for $D, which has been in the midst of a six-week down trend. Every pull-back has been a selling opportunity recently, which bodes well for the current sell signal.

If price remains below $42.50, this stock has a shot at dropping below $41 in the days ahead, with a target somewhere between $40.50 and $41.00.

Bearish Confluence

There are two additional layers of pivot-based resistance that form a powerful form of bearish confluence: the pivot range and the yearly H3 Camarilla pivot level.

During trending markets, the pivot range can serve as support in an uptrend, and resistance in a down trend. Since $D is currently holding below the top of the pivot range at $42.40, downtrending behavior should remain intact.

Watch for a break through the bottom of the range at $41.80 for signs of downside follow-through.

Additionally, the $42.40 level also happens to be the yearly H3 Camarilla pivot level, which is usually seen as a bearish zone. Clearly, $D has responded to this pivot and price level throughout the year, which means another round of selling could be ahead.

Again, as long as $42.50 remains untouched, look for a potential drop back toward $40.50 to $41.00.

Let’s see how this one plays out!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss