Apple, Inc. (AAPL) has dropped nearly 10% from the March high of $361.67, which was set two weeks ago. Of any stock over the last two years, this one has been the poster child for a “buy the dip” philosophy. But is now the time to buy? Here are my thoughts..

Support at $326

The daily chart shows AAPL dropped about 4.5% in the recent session, closing the day just above the multi-month support level of $326, which has held throughout 2011 thus far. This is the level to watch for near-term responsive buying participation. If buyers cannot defend this level, we will likely see more weakness ahead.

There is double pivot support at $324.75, which includes the S2 (Floor) and L5 (Camarilla) pivots. If price can continue to hold above this zone, we could see buyers enter the market – much like what was seen in mid-January.

Otherwise, a violation of this zone could open the door to a price-probe in the low $300’s once again.

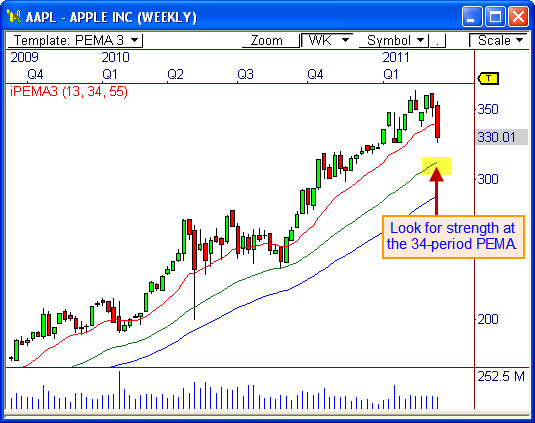

PEMA Support

The weekly chart offers an amazing view of potential support using the PEMA Method. Using pivot-based multiple moving averages, you see that every pull-back that tested the 34-period PEMA (the middle line) led to responsive buying participation over the last two years in this stock.

If price drops into the 34-period PEMA, take this as a major sign to buy this stock below value. Currently, the 34-period PEMA sits at about $312.40, but this level will fluctuate a bit by the time price reaches it.

If price does respond to the $312-15 zone with buying interest, I could see a very nice advance along the lines of an 80-point rally.

Stereotyping Market Days

There’s still time to sign up for my course “Stereotyping Market Days”, which is Thursday night (March 17th). Don’t worry if you can’t make the live event, as the webinar will be recorded for playback at your convenience. CLICK HERE to learn how you can save $100 on this course AND to learn how you can receive FREE in the market coaching!

Let’s see how this one plays out!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss