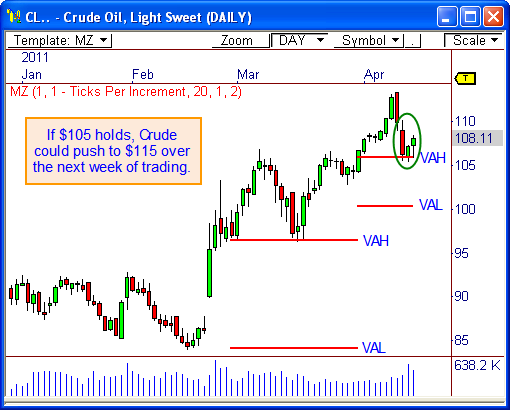

Crude Oil futures has been extremely bullish the last two months, especially when resistance was taken out at $93 in February. Given recent weakness, this could be a great opportunity to buy ahead of a test at $115..

Major Support

The daily chart shows Crude Oil has been taking the staircase to higher price levels the last few months. What’s interesting is the fact that the top of the value area – the value area high – has served as support the last two months, which is very bullish.

Short term weakness led price directly to the VAH the last three days, where buyers have defended the level.

If buyers continue to defend VAH, and even the $105 level, we could see a very nice advance toward the $115 level in the week ahead – and potentially higher! If price breaks $105, all bets are off, however.

The Game Plan

If price opens the day with early strength, watch $108.60 for breakout entries. If price opens with modest weakness, however, look to buy into weakness as low as $106.85. If price gaps down below $106.50, we could be headed for a test of $105.

Let’s see what the day brings us!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss