The E-Mini S&P 500 futures contract has trended steadily lower during the last week of trading, but today’s late-day rally could spark a new wave of strength ahead. Here’s why..

Critical Support

The daily chart shows buyers defended the 1,070 level in the ES today, which has served as key support since August. As a matter of fact, this level marks the low of the decline that occurred at the end of July and the beginning of August, thus illustrating where the market found price levels to be undervalued.

This is a very important price level, as it basically marks the last zone of support before the 1,000 level. If 1,070 is violated, we will likely see a steady sell-off back toward 1,000.

However, if buyers can continue to defend 1,070, we could see a very nice short term rally off 1,070 back toward 1,150 or higher. Heck, price rallied about 125 points off 1,070 in August, so maybe it will happen again.

Either way, 1,070 remains the level to watch.

Late-Day Rally

The 15-minute chart shows price formed a lazy higher low late in the day and then launched into full-on rally mode in the last 45 minutes of the session, rallying nearly 50 points into the close.

This was the biggest rally we’ve seen in two weeks and hints at continued strength tomorrow.

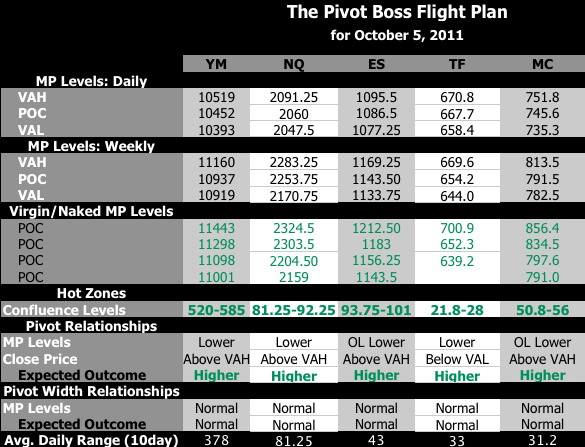

A Lower Value relationship has formed for tomorrow’s market with the Market Profile levels. While this is usually an indication of weakness (as seen over the last week), the fact that price closed well above what will be tomorrow’s Value Area High (VAH) indicates strength.

This actually bodes quite well for the bulls if buyers can defend a morning pull-back to 1,100, or lower.

Game Plan

Given the late-day rally, critical support in the daily chart, and the contradictory Lower Value setup, I think price will attempt to push higher tomorrow.

If price opens the session above 1,105, look to buy into weakness between 1,093.75 and 1,101. There is a nice zone of pivot-based confluence in this area that could help pave the way to a steady advance. Look to play targets at 1,125.25, 1,133.50, and 1,143.50.

If price opens the session below 1,090, I will hold off on Longs and re-evaluate the setup.

Here are the rest of the key levels to watch for all the E-Mini’s tomorrow. Enjoy!

Let’s see how this one plays out!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss