Apple, Inc. (AAPL) has been incredibly bullish during the current 4-year rally, offering amazing buying opportunities along the way. The current pull-back could be one of those buying opportunities. Here’s why…

Floor Pivot Support

Part of the research I conducted for my book Secrets of a Pivot Boss included pivot-trend analysis. One of the components was how price behaved during trending phases.

One key takeaway from my research was clear – in virtually all strong trending markets price rarely closed below the S1 support level, and mostly never even tested it.

Therefore, if the stock you are trading has remained above the S1 support level for consecutive months, it’s likely in a strong bull trend, which means you should be looking to buy into weakness along the way.

Buy the dips.

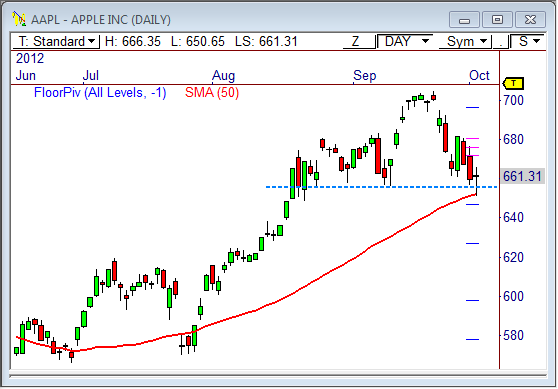

In the daily chart of AAPL, you see price put in a bullish reversal wick just ahead of October’s monthly S1 pivot level, meaning this could be the low for the month.

AAPL has only closed below monthly S1 just once in the last 15 months.

Major Confluence

The daily chart also shows Yesterday’s bullish reversal wick candlestick also formed at a 3-way confluence zone that includes the monthly S1 pivot, 5-week visual support, and the 50-day simple moving average.

The market tested the waters below the $655.75 visual support zone, but responsive buyers saw value and bought.

Additionally, the 50-period moving average is a spot where many big players have been known to enter the market during clear trends, which was clearly the case this time around.

It’s not a coincidence that the reversal wick formed right at the 50sma, it’s first test in over two months.

Buy the Dip

If price remains above the monthly S1 pivot at $646.80, continued uptrending price movement is expected ahead.

If we assume that yesterday’s low of $650.65 is the October low, then we can project 5- and 10-day targets of $688.88 and $697.91, respectively, using my ADR Method swing calculations.

Keep in mind, if this is the true point to buy the dip, then much more strength lies ahead, likely toward $750 by the end of November.

Only time will tell.

What are your thoughts? Agree or disagree?

Cheers!

Frank Ochoa

PivotBoss | Own the Market

Follow us on Twitter: http://twitter.com/PivotBoss

[cc_h_line color=”888888″]

[cc_list_posts post_type=”post” amount=”3″ img_position=”left”]

I agree Frank. Apple’s low yesterday was on the weekly S1 pivot point. The monthly S1 at $646 holds approx 72% of the time.

Weekly pivot-based support, too!? I’ll take it!

Obvious bounce at 50dma and strong close tonight too so should gap up tomorrow again.

We are now testing the top trend line of the recent doward channel lets see if this holds. There is also still the bearish H&S in play so this cannot be negated yet.

Also how does this fit in with your other post abour NQ falling?? Surely if apple is a buy then the other post is invalid?

Great points Adz!

You are right, the NQ and AAPL posts definitely seem to contradict each other.

The level to keep in mind in the NQ is 2,825. This is the bail out level. If the NQ surges through 2,825, then all bearish indications are likely off, and the contract is headed higher.

A failed pattern oftentimes leads to a stronger move, which bodes well for the AAPL call..

If 2,825 continues to hold as resistance, then more downside price discovery is likely.

Either way, price is definitely coiling for a move…let the market decide which way, then react accordingly.

Thanks pivotboss.

I still think we are on the borderline here even though 2825 has been taken out its not been with conviction. NFP to decide direction then we see where we go from there