PB View

We’re seeing weakness across the board during pre-market trading this morning, especially after the bulls were unable to convert the 1686 level in E-Mini S&P 500 futures, and the 3060 level in the E-Mini NASDAQ 100 futures. Rejections at these levels have sent the market lower this morning, but there are key support zones down below that the bears are gunning for, which the bears have defended during the recent advance.

The market has clearly rested during the recent stretch of trading, but this rest opens the door to the next big swing move, so watch the price cues in the charts for directional conviction.

Continue to watch Crude off 104.20, which is a huge level in the chart right now. A break or bounce of this zone will likely lead to the next 2 buck swing. The main level to watch in Gold is 1320, as a break sees 1310, and a bounce sees 1335.

Cheers!

Frank Ochoa

PivotBoss | Own the Market

Follow me on Twitter: @PivotBoss

______________________________________________________

This daily report is currently free and open to the public, as I gather feedback and ideas ahead of a formal subscription offering later in the summer. If you have any feedback regarding anything in the report (good or bad) please provide it below in the comments section. Your comments will definitely help shape the report for the better. Thank you!

E-Mini S&P 500

In yesterday’s ES report I wrote, “An upside push through 1678 would forecast short term strength toward 1684.50 to 1686, but buying may be capped at the top end of this range.”

The E-Mini S&P 500 futures opened Thursday’s session with a ton of back and forth trading, but eventually got a push beyond 1678, which led to tests at 1684.50 and 1686. As a matter of fact, the ES topped out at 1686.50 during RTH trading, which further reinforces the strength of the 86s.

This morning has been all downtrending for the ES, however, as prices have slid from overnight highs of 1689 to a current last price of 1675.50. The big level to watch below is 1672. A break of this zone could open up a very important test of 1665 to 1666, which is a zone with a big time LVN. A break here paves the way to 1650, while a hold suggests new highs above.

The next swing move may very well depend on 1672 and 1690, so watch this range closely ahead. By the way, we have yet to hit a weekly target, and the closest one is the primary bear at 1663.25.

Today’s scheduled economic news:

8:55am CT Revised UofM Consumer Sentiment

8:55am CT Revised UofM Inflation Expectations

Here are the Key Levels and Targets for the current session:

| PivotBoss Levels & Targets: E-Mini S&P 500 (ESU3) | |||||

| Jul 26, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 1,708.25 | Monthly R2 | ADR (10) | ONH | ONL | |

| 1,697.75 | Monthly H5 | 12.75 | 1,689.00 | 1,678.00 | |

| 1,692.00 | LVN | AWR (10) | WH | WL | |

| 1,691.00 | Fib Ext | 43.00 | 1,695.50 | 1,671.75 | |

| 1,686.50 | PD High | ||||

| 1,684.00 | SETTLE/VPOC | DAILY TARGETS | WEEKLY TARGETS | ||

| 1,682.00 | LVN | BULL | BEAR | BULL | BEAR |

| 1,677.50 | cVPOC | 1,693.94 | 1,682.63 | 1,714.75 | 1,663.25 |

| 1,674.75 | PD Low | 1,690.75 | 1,679.44 | 1,704.00 | 1,652.50 |

| 1,673.00 | LVN | 1,687.56 | 1,676.25 | ||

| 1,670.75 | 13PEMA | 1,684.38 | 1,673.06 | ||

| 1,670.50 | nVPOC | *BOLD indicates primary objectives | |||

| 1,670.25 | Fib Ext | ||||

| 1,670.00 | HVN | ||||

| 1,666.25 | LVN | ||||

| 1,665.50 | LVN | ||||

| 1,664.25 | nVPOC | ||||

| 1,662.00 | LVN | ||||

| 1,656.00 | HVN | ||||

| 1,652.25 | LVN | ||||

| 1,648.75 | Open Gap | ||||

E-Mini NASDAQ 100

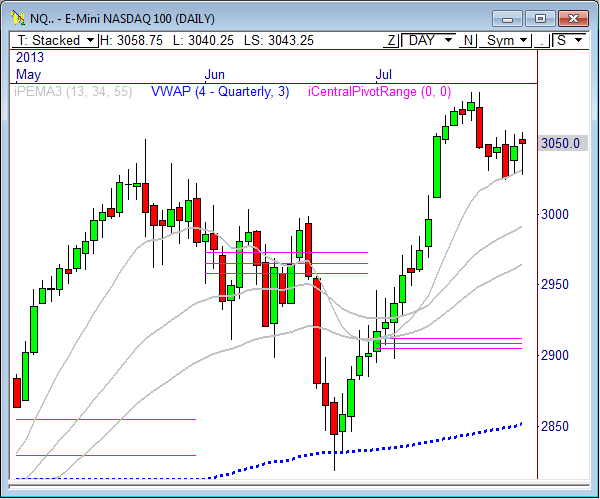

In yesterday’s NQ report I wrote, “We’ve seen big weakness, followed by strength during pre-market trading already this morning, but the NQ remains within the boundaries of yesterday’s range, which spans from 3028.75 to 3057.25.”

Once again, the NASDAQ traded within the boundaries of the large trading range that continues to develop from 3024 to 3060. We are working on our sixth day of trading within this range, and the market is clearly awaiting directional resolution upon a breakout.

The fact that this range is sitting on the 13-period pivot-based EMA in the daily chart indicates likely strength ahead. However, it won’t be easy, as there is overhead resistance from 3060 to as high as 3070. But if the NQ can make it through this zone, there’s an easy path to new highs.

A break through the bottom of the trading range at 3024 offers clear air to 3000, with the potential to reach as low as 2991. As a matter of fact, if the 2991 level is reached, look to be a swing buyer of the dip, as this level encompasses a ton of confluence.

Today’s session will start off much like the last several days of trading, with bounces occurring off the outer boundaries of the range. This should be the primary tactic, until proven otherwise.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: E-Mini NASDAQ 100 (NQU3) | |||||

| Jul 26, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 3,096.00 | Monthly H5 | ADR (10) | ONH | ONL | |

| 3,086.00 | LVN | 24.5 | 3,058.75 | 3,040.25 | |

| 3,074.75 | HVN | AWR (10) | WH | WL | |

| 3,074.50 | nVPOC | 94.25 | 3,060.00 | 3,023.50 | |

| 3,067.50 | Fib Ext | ||||

| 3,062.75 | LVN | DAILY TARGETS | WEEKLY TARGETS | ||

| 3,058.25 | PD High | BULL | BEAR | BULL | BEAR |

| 3,052.50 | VPOC | 3,070.88 | 3,046.50 | 3,117.75 | 2,989.31 |

| 3,050.75 | SETTLE | 3,064.75 | 3,040.38 | 3,094.19 | 2,965.75 |

| 3,046.00 | LVN | 3,058.63 | 3,034.25 | ||

| 3,034.00 | cVPOC/PD Low | 3,052.50 | 3,028.13 | ||

| 3,030.75 | 13PEMA | *BOLD indicates primary objectives | |||

| 3,027.50 | LVN | ||||

| 3,024.75 | Fib Ext | ||||

| 3,008.00 | nVPOC | ||||

| 2,997.00 | Open Gap | ||||

| 2,995.00 | nVPOC | ||||

| 2,991.00 | HVN | ||||

Crude Oil

In yesterday’s Crude report I wrote, “The key short term pivot for CL is 105.00 this morning. If price remains beneath this zone, we’re likely to see a retest of major support down below at 104.20, which is a zone the bulls must hold if they want to gain momentum toward 110.”

Crude Oil finally got a big time test of the 104.20 level during Thursday’s trading, and dropped to 104.08 before finally catching a bid and rallying the rest of the day. I bought Crude off the test of the 104.20 LVN at 104.30 and scaled out twice, with a max scale at 104.85 (with positive slippage!). Clearly, there was much more left in the tank, as price rallied to a high of 105.87 before calling it a day.

While the daily chart shows a bullish tail forming off the 104.20 level, today’s pre-market trading has CL trending steadily lower, and a retest of 104.20 just occurred, making this level the one to watch again.

If Crude continues to hold the 104.20 level, look for a move to 105.22 and 106. A violation of 104.20 forecasts 103.65 and 103.40.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: Crude Oil (CLU3) | |||||

| Jul 26, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 110.00 | Yearly R1 | ADR (10) | ONH | ONL | |

| 108.32 | LVN | 1.98 | 105.63 | 104.34 | |

| 107.71 | Monthly R3 | AWR (10) | WH | WL | |

| 107.34 | cVPOC | 5.90 | 108.60 | 104.08 | |

| 106.55 | Fib Ext | ||||

| 106.40 | LVN | DAILY TARGETS | WEEKLY TARGETS | ||

| 105.87 | PD High | BULL | BEAR | BULL | BEAR |

| 105.52 | VPOC | 106.82 | 104.64 | 109.98 | 104.18 |

| 105.49 | SETTLE | 106.32 | 104.15 | 108.51 | 102.70 |

| 105.12 | HVN | 105.83 | 103.65 | ||

| 104.69 | LVN | 105.33 | 103.16 | ||

| 104.08 | LVN/PD Low | *BOLD indicates primary objectives | |||

| 103.73 | LVN | ||||

| 103.52 | Open Gap | ||||

| 103.40 | Fib Ext | ||||

| 103.00 | HVN | ||||

Gold

In yesterday’s Gold report I wrote, “we could see another test of pre-market lows in the 1308.40 to 1310 zone, which by the way is a zone that offers big time confluence, thus the big bounce that occurred there this morning. This zone is the area that the bulls must defend, while the bears want to keep a lid on 1348.”

There was no retest of the 1308.40 to 1310 zone of support, as this level provided enough buyers to lift the market directly to 1330 before the day’s RTH session ended, providing another big move in this hot commodity.

As I mentioned before, the 1308 to 1310 zone offers a heavy confluence of support. If this zone continues to hold, especially upon a retest, we could see new highs beyond the 1348 level, likely toward 1378.80 over the upcoming week. However, 1310 must continue to hold. As a matter of fact, Gold is already dropping off recent pre-market highs of 1340.50 and is approaching 1320. The bulls want to keep this bull run alive, so I’d say the 1320 zone must hold on a retest to have a chance at forming a higher low above 1310, which will add more fuel to an upside break.

Eventually, a push through 1340.50 will need to occur, which will put pressure on the bears to defend 1348 once again. However, if 1320 doesn’t hold a failed retest of 1310 occurs, we could see a quick strike back to 1300, so watch this zone of support closely.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: Gold (GCQ3) | |||||

| Jul 26, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 1,385.50 | cVPOC | ADR (10) | ONH | ONL | |

| 1,371.40 | Monthly R1 | 25.4 | 1,340.50 | 1,322.80 | |

| 1,357.80 | Monthly H4 | AWR (10) | WH | WL | |

| 1,345.50 | 55PEMA | 60.20 | 1,348.70 | 1,295.40 | |

| 1,345.20 | LVN | ||||

| 1,338.00 | LVN | DAILY TARGETS | WEEKLY TARGETS | ||

| 1,337.30 | Fib Ext | BULL | BEAR | BULL | BEAR |

| 1,335.40 | nVPOC | 1,354.55 | 1,327.80 | 1,355.60 | 1,303.55 |

| 1,334.90 | HVN | 1,348.20 | 1,321.45 | 1,340.55 | 1,288.50 |

| 1,331.90 | PD High | 1,341.85 | 1,315.10 | ||

| 1,328.70 | SETTLE | 1,335.50 | 1,308.75 | ||

| 1,328.00 | cVPOC | *BOLD indicates primary objectives | |||

| 1,326.00 | LVN | ||||

| 1,325.60 | VPOC | ||||

| 1,323.70 | LVN | ||||

| 1,317.60 | PD Low | ||||

| 1,316.40 | LVN | ||||

| 1,313.50 | 34PEMA | ||||

| 1,312.20 | Fib Ext | ||||

| 1,310.00 | LVN | ||||

| 1,309.00 | 50% Fib | ||||

| 1,301.30 | Monthly TC | ||||

| 1,299.00 | LVN/62% Fib | ||||

es 1770.5 nvpoc calls the bottom

Pingback: Big Week Ahead for the Market | PivotBoss