PB View

The S&P 500 and NASDAQ 100 futures each got decent downside breaks from their respective coiled ranges Tuesday, but more downside could be seen early in today’s market if price continues to remain beneath the important 1695 pivot.

Keep in mind, however, the market continues to remain extremely bullish until proven otherwise. Don’t fall in love with the down move, as this pull-back could be another great opportunity to buy within the current bull run.

Cheers!

Frank Ochoa

PivotBoss | Own the Market

Follow me on Twitter: @PivotBoss

______________________________________________________

This daily report is currently free and open to the public, as I gather feedback and ideas ahead of a formal subscription offering later in the summer. If you have any feedback regarding anything in the report (good or bad) please provide it below in the comments section. Your comments will definitely help shape the report for the better. Thank you!

E-Mini S&P 500

From yesterday’s report, “The E-Mini S&P 500 futures are holding within a very tightly-coiled range that spans from 1696 to 1705. This range has formed at all-time highs over the last four sessions, but could be due for a breakout soon…The current overnight high of 1703.50 suggests bear targets at 1693.50 and 1690.25.”

The E-Mini S&P 500 futures got a solid downside break from the 4-day consolidation range and reached both of the primary bear targets of 1693.50 and 1690.25. Price bottomed out at 1688.75 and held within a tight range into the close, which forecasts further weakness for Wednesday morning.

The major dividing line between the bulls and bears is 1695. This is the pivot to use for today’s trading, as you should be focused Long above it, and Short below it. In the short term, the 1690 to 1691 zone has become overnight resistance and could lead to another wave of weakness ahead if this level continues to hold firm.

The 1685.50 level has been a major source of support during pre-market trading. A violation of this level opens the door to more downside price discovery toward targets of 1683.25 and 1679.75. If this level continues to hold, look to upside targets at 1695.50 and 1699.

Today’s scheduled economic news:

9:30am CT Crude Oil Inventories

12:00pm CT 10-year Bond Auction

2:00pm CT Consumer Credit m/m

Here are the Key Levels and Targets for the current session:

| PivotBoss Levels & Targets: E-Mini S&P 500 (ESU3) | |||||

| Wed, Aug 7, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 1,722.50 | Monthly R1 | ADR (10) | ONH | ONL | |

| 1,713.00 | Monthly H3 | 13.75 | 1,693.50 | 1,685.25 | |

| 1,705.00 | Fib Ext | AWR (10) | WH | WL | |

| 1,705.00 | LVN | 26.50 | 1,705.00 | 1,685.25 | |

| 1,702.50 | Open Gap | ||||

| 1,700.50 | PD High | DAILY TARGETS | WEEKLY TARGETS | ||

| 1,695.25 | Monthly VAH | BULL | BEAR | BULL | BEAR |

| 1,695.00 | LVN | 1,702.44 | 1,686.63 | 1,711.75 | 1,685.13 |

| 1,694.00 | SETTLE | 1,699.00 | 1,683.19 | 1,705.13 | 1,678.50 |

| 1,693.00 | VPOC | 1,695.56 | 1,679.75 | ||

| 1,688.75 | PD Low | 1,692.13 | 1,676.31 | ||

| 1,687.00 | 13PEMA | *BOLD indicates primary objectives | |||

| 1,686.75 | nVPOC | ||||

| 1,685.00 | Open Gap | ||||

| 1,684.50 | Fib Ext | ||||

| 1,683.50 | cVPOC | ||||

| 1,677.50 | HVN | ||||

| 1,673.00 | LVN | ||||

E-Mini NASDAQ 100

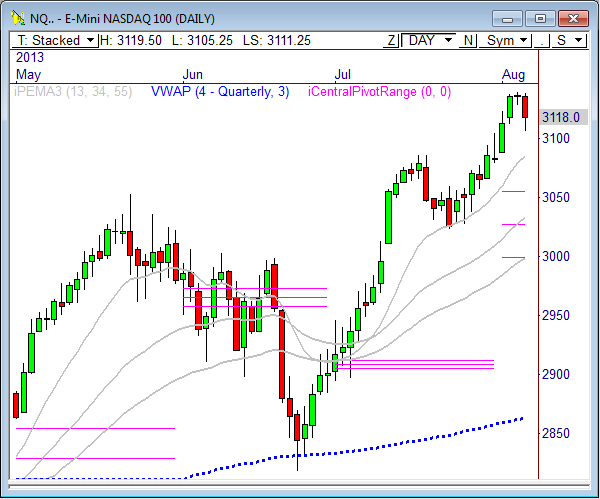

From yesterday’s report, “The E-Mini NASDAQ 100 futures are trading within a very tight 3-day range at recent highs, which spans from 3128 to 3140. A breakout from this range could spark the next short term directional move, so watch the boundaries closely. There is a nice zone of confluence between 3122.50 and 3123.75 that could find support. There’s nothing below this range, however, until a LVN comes into view at 3113.50.”

The E-Mini NASDAQ 100 futures opened Tuesday’s market with early selling pressure out of the 3-day range, which sparked a decent sell-off that didn’t subside until price hit 3106.25. Price closed the session with a tight range that formed at lows, and is now trading near the lower distribution of the range in pre-market trading.

Short term, there is a ton of overhead resistance between 3122.50 and 3128. If price cannot push through this zone, we could see another round of weakness down toward 3106.25 and 3100. The 3106.25 level is a solid LVN, so it should provide support on first test. A violation of this level opens the door to a potential fill of the open gap below at 3092.50.

The current overnight low of 3105.25 projects bull targets at 3119 and 3126, while the overnight high of 3119.50 forecasts bear targets at 3105.75 and 3098.75.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: E-Mini NASDAQ 100 (NQU3) | |||||

| Wed, Aug 7, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 3,160.50 | Monthly R1 | ADR (10) | ONH | ONL | |

| 3,147.50 | Fib Ext | 27.75 | 3,119.50 | 3,105.25 | |

| 3,141.00 | Monthly H3 | AWR (10) | WH | WL | |

| 3,140.00 | LVN | 63.75 | 3,140.25 | 3,105.25 | |

| 3,136.25 | PD High | ||||

| 3,130.50 | LVN | DAILY TARGETS | WEEKLY TARGETS | ||

| 3,118.75 | SETTLE | BULL | BEAR | BULL | BEAR |

| 3,117.50 | VPOC | 3,139.94 | 3,105.63 | 3,169.00 | 3,092.44 |

| 3,106.25 | PD Low | 3,133.00 | 3,098.69 | 3,153.06 | 3,076.50 |

| 3,106.25 | LVN | 3,126.06 | 3,091.75 | ||

| 3,095.00 | Fib Ext | 3,119.13 | 3,084.81 | ||

| 3,092.75 | HVN | *BOLD indicates primary objectives | |||

| 3,092.50 | Open Gap | ||||

| 3,075.00 | HVN | ||||

| 3,062.75 | LVN | ||||

| 3,034.00 | cVPOC | ||||

Crude Oil

From yesterday’s report, “If 105.75 continues to hold, I’m looking for price to rally back toward prior highs at 108.80, with a shot to reach 110 and 111.85. A break and hold of 105.75 kills this theory.”

Crude rallied during pre-market trading heading into Tuesday’s open and reached a high of 107.27 before finally succumbing to a major sell-off. Crude took out the important 105.75 level and dropped sharply, putting in a low of 104.86 on the day. I was taken out of the second half of my Crude Long at 105.95 for a nice profit on the overall trade, and I await a big test at 104 ahead.

The Key Levels ladder below indicates a strong confluence of support between 104.05 and 104.11. Also, we’ve known the 104 to 104.30 zone to be very active in recent weeks. If price drops into this zone again, we could see another nice round of buying.

Crude has formed a clear trading range from 104.86 to 105.82 in overnight trading. This range has formed very cleanly, and could forecast the next short term move upon a breakout. Watch the boundaries closely.

The current overnight high of 105.77 forecasts bear targets at 104.68 and 104.14, while the overnight low of 105.01 indicates a move to 106.10 and 106.65.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: Crude Oil (CLU3) | |||||

| Wed, Aug 7, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 110.00 | Yearly R1 | ADR (10) | ONH | ONL | |

| 108.48 | LVN | 2.18 | 105.77 | 105.01 | |

| 108.00 | LVN | AWR (10) | WH | WL | |

| 107.59 | nVPOC | 4.54 | 107.69 | 104.86 | |

| 107.58 | Fib Ext | ||||

| 107.35 | LVN | DAILY TARGETS | WEEKLY TARGETS | ||

| 106.83 | PD High | BULL | BEAR | BULL | BEAR |

| 106.83 | HVN | 107.74 | 104.68 | 109.40 | 104.29 |

| 105.88 | HVN | 107.19 | 104.14 | 108.27 | 103.15 |

| 105.44 | cVPOC | 106.65 | 103.59 | ||

| 105.38 | VPOC | 106.10 | 103.05 | ||

| 105.31 | SETTLE | *BOLD indicates primary objectives | |||

| 105.05 | Open Gap | ||||

| 104.86 | PD Low | ||||

| 104.59 | nVPOC | ||||

| 104.11 | Fib Ext | ||||

| 104.05 | LVN | ||||

| 103.00 | HVN | ||||

| 102.27 | LVN | ||||

Gold

From yesterday’s report, “Gold is holding within a very tight range from 1287 to 1296 after selling off from 1306 last night. This range will likely dictate the day’s early directional move, so watch the boundaries closely. An upside push through 1296 forecasts targets at 1300.1 and 1306.6, while a downside push through 1287 suggests a target of 1280.1.”

Gold failed to rise back above the 1300 level and completely fell apart during Tuesday’s trading, as price dropped through overnight support at 1287 en route to a huge sell-off to 1278. My Long position was taken out for a loss, but I later recouped the trade’s losses by shorting 1287.40, of which I’m still holding half the position. I’m looking to take the last half of the trade off at either 1271.30 or 1264, depending on how this morning plays out.

There is an important LVN at 1270.50, which will serve as major support. If this level continues to hold firm, we could see a bounce back toward 1296. A break at 1270.50 could open the door to a test back toward 1264. Watch 1283.70 closely, as this level represents the cumulative VPOC over the last month. Use this level as the day’s pivot, positioning yourself short below it, and long above.

The current high of 1284 forecasts bear targets at 1270.7 and 1264, while the day’s current low of 1271.8 forecasts bull targets at 1285.10 and 1291.80.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: Gold (GCQ3) | |||||

| Wed, Aug 7, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 1,329.30 | nVPOC | ADR (10) | ONH | ONL | |

| 1,316.50 | LVN | 26.7 | 1,284.00 | 1,271.80 | |

| 1,312.20 | HVN | AWR (10) | WH | WL | |

| 1,311.70 | nVPOC | 55.30 | 1,320.30 | 1,271.80 | |

| 1,305.30 | nVPOC | ||||

| 1,300.90 | Monthly TC | DAILY TARGETS | WEEKLY TARGETS | ||

| 1,296.20 | Fib Ext | BULL | BEAR | BULL | BEAR |

| 1,293.50 | HVN | 1,305.18 | 1,270.65 | 1,327.10 | 1,278.83 |

| 1,291.20 | PD High | 1,298.50 | 1,263.98 | 1,313.28 | 1,265.00 |

| 1,288.00 | LVN | 1,291.83 | 1,257.30 | ||

| 1,283.75 | cVPOC | 1,285.15 | 1,250.63 | ||

| 1,282.40 | SETTLE | *BOLD indicates primary objectives | |||

| 1,278.10 | PD Low | ||||

| 1,273.20 | Fib Ext | ||||

| 1,270.52 | LVN | ||||

| 1,260.00 | LVN | ||||

| 1,254.40 | HVN | ||||