PB View

The market experienced a mild two-day dip, and that’s all that was needed for the bulls to take advantage of another buying opportunity. The S&P 500 and NASDAQ 100 futures are both pushing higher heading into the RTH open, and overnight volume was the healthiest of the week, so more upside could be seen ahead.

Price is coming into major resistance, however, which should be watched very closely for signs of a continuation, or failure. But all signs point to more upside, as the daily charts remain quite bullish.

Keep an eye on key weekly bull targets above, as these could be hit by the end of the week.

Cheers!

Frank Ochoa

PivotBoss | Own the Market

Follow me on Twitter: @PivotBoss

______________________________________________________

This daily report is currently free and open to the public, as I gather feedback and ideas ahead of a formal subscription offering later in the summer. If you have any feedback regarding anything in the report (good or bad) please provide it below in the comments section. Your comments will definitely help shape the report for the better. Thank you!

E-Mini S&P 500

From yesterday’s report, “The 1685.50 level has been a major source of support during pre-market trading. A violation of this level opens the door to more downside price discovery toward targets of 1683.25 and 1679.75.”

The E-Mini S&P 500 eventually got a push below the 1685.50 level Wednesday morning, which paved the way for another round of selling down to 1680.50, which marked the low of the day and came within a few ticks of my last target. I actually held an overnight Short in the ES from 1693.50 and scaled out of the first half of the trade at 1687, and exited the last half of my trade at 1685.50 after my final target was missed.

The ES staged a decent reversal from the 1680.50 lows during Wednesday’s RTH session, but price continued its upward pace overnight and during pre-market trading. However, the ES has stalled right at the 1695 level, which has been the major dividing line between the bulls and bears over the last several sessions. Continue to use this level as the pivot, staying long above and short below.

The ES still has a full range weekly bull target to reach above at 1707. If the bulls can convert the 1695 level, then 1707 is a great target to watch for the end of the week. If the bears maintain control of 1695, then a retest of 1690 may occur, which could pave the way for another test at the Wednesday lows.

The current pre-market low of 1687.75 forecasts bulls targets at 1698 and 1701.50, while the overnight high of 1695.50 suggests bear targets at 1688.75 and 1685.25.

Today’s scheduled economic news:

7:30am CT Unemployment Claims

9:30am CT Natural Gas Storage

12:00pm CT 30-y Bond Auction

Here are the Key Levels and Targets for the current session:

| PivotBoss Levels & Targets: E-Mini S&P 500 (ESU3) | |||||

| Thu, Aug 8, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 1,722.50 | Monthly R1 | ADR (10) | ONH | ONL | |

| 1,713.00 | Monthly H3 | 13.75 | 1,695.50 | 1,687.75 | |

| 1,705.00 | LVN | AWR (10) | WH | WL | |

| 1,702.50 | Open Gap | 26.50 | 1,705.00 | 1,680.50 | |

| 1,702.50 | nVPOC | ||||

| 1,695.25 | Monthly VAH | DAILY TARGETS | WEEKLY TARGETS | ||

| 1,695.00 | LVN | BULL | BEAR | BULL | BEAR |

| 1,693.00 | nVPOC | 1,704.94 | 1,688.63 | 1,707.00 | 1,685.13 |

| 1,689.50 | PD High | 1,701.50 | 1,685.19 | 1,700.38 | 1,678.50 |

| 1,688.00 | SETTLE | 1,698.06 | 1,681.75 | ||

| 1,687.50 | VPOC | 1,694.63 | 1,678.31 | ||

| 1,687.00 | 13PEMA | *BOLD indicates primary objectives | |||

| 1,683.50 | cVPOC | ||||

| 1,680.50 | PD Low | ||||

| 1,677.50 | HVN | ||||

| 1,673.00 | LVN | ||||

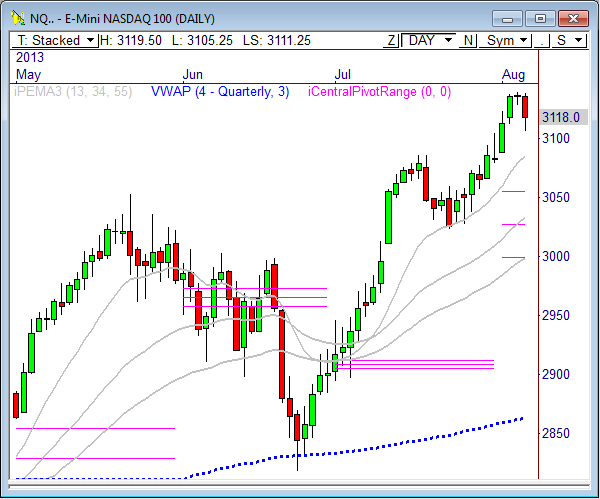

E-Mini NASDAQ 100

From yesterday’s report, “Short term, there is a ton of overhead resistance between 3122.50 and 3128. If price cannot push through this zone, we could see another round of weakness down toward 3106.25 and 3100.”

The E-Mini NASDAQ 100 futures remained beneath 3022.50 early in the session Wednesday morning and dropped right into the 3100 level, and even got as low as 3090.75 before finally seeing buyers. Price has since rallied nicely off the 90.75 lows and even pushed through the 3122.50 to 3128 band of resistance in pre-market trading.

The pre-market trend has been strong, meaning that every pullback to value should be a buying opportunity as long as price remains above 3120, which is the key pivot for the session.

There is a major zone of resistance between 3140 and 3141. Watch this zone closely, as a break or failure in this area could predict the next short term move.

The current overnight low of 3116 suggests upside bull targets at 3136.75 and 3143.75, while the pre-market high of 3132.50 forecasts bear targets at 3118.50 and 3111.75.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: E-Mini NASDAQ 100 (NQU3) | |||||

| Thu, Aug 8, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 3,160.50 | Monthly R1 | ADR (10) | ONH | ONL | |

| 3,141.00 | Monthly H3 | 27.75 | 3,131.00 | 3,116.00 | |

| 3,140.00 | LVN | AWR (10) | WH | WL | |

| 3,134.50 | HVN | 63.75 | 3,140.25 | 3,090.75 | |

| 3,130.50 | LVN | ||||

| 3,122.00 | LVN | DAILY TARGETS | WEEKLY TARGETS | ||

| 3,119.50 | PD High | BULL | BEAR | BULL | BEAR |

| 3,116.00 | HVN | 3,150.69 | 3,117.13 | 3,154.50 | 3,092.44 |

| 3,115.75 | SETTLE | 3,143.75 | 3,110.19 | 3,138.56 | 3,076.50 |

| 3,114.75 | VPOC | 3,136.81 | 3,103.25 | ||

| 3,110.25 | HVN | 3,129.88 | 3,096.31 | ||

| 3,105.25 | LVN | *BOLD indicates primary objectives | |||

| 3,092.75 | HVN | ||||

| 3,090.75 | PD Low | ||||

| 3,090.00 | LVN | ||||

| 3,088.50 | 13PEMA | ||||

| 3,075.00 | HVN | ||||

| 3,069.50 | nVPOC | ||||

| 3,062.75 | LVN | ||||

| 3,034.00 | cVPOC | ||||

Crude Oil

From yesterday’s report, “The Key Levels ladder below indicates a strong confluence of support between 104.05 and 104.11. Also, we’ve known the 104 to 104.30 zone to be very active in recent weeks. If price drops into this zone again, we could see another nice round of buying.”

Crude dropped right into the 104.05 to 104.11 zone late Wednesday afternoon and found buyers, as price dipped to 104.10 before rallying to 104.96 overnight. I bought Crude at 104.13 and dumped half the trade at 104.47, and let the last half ride risk free. I was eventually taken out upon a break back below 104 this morning, but made money on the trade as a whole.

The 60-minute chart shows Crude is currently in a clear 5-day downtrend. The recent reversal just below the 105 level solidifies this zone as the key upside pivot to watch, while 104 continues to be the support zone to watch short term. A break above 105 opens the door to a big retest at the major 105.75 level. But until 105 is breached, we’ll likely continue to see further downtrending behavior toward the full range weekly bear target at 103.15.

At some point, we may see a big test between 103.23 and 103.48, which is a key zone in the daily timeframe that usually suggests a swing bounce. I’ll be watching this zone for signs of buying activity that could offer clues for a swing move higher down the road.

The current high of 104.96 forecasts bear targets at 103.41 and 102.89, while the current low of 103.71 suggests upside targets at 104.83 and 105.34.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: Crude Oil (CLU3) | |||||

| Thu, Aug 8, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 110.00 | Yearly R1 | ADR (10) | ONH | ONL | |

| 108.48 | LVN | 2.07 | 104.96 | 103.79 | |

| 108.00 | LVN | AWR (10) | WH | WL | |

| 107.59 | nVPOC | 4.54 | 107.69 | 104.01 | |

| 107.35 | LVN | ||||

| 106.83 | HVN | DAILY TARGETS | WEEKLY TARGETS | ||

| 106.05 | Fib Ext | BULL | BEAR | BULL | BEAR |

| 105.88 | HVN | 106.38 | 103.93 | 108.55 | 104.29 |

| 105.75 | LVN | 105.86 | 103.41 | 107.42 | 103.15 |

| 105.53 | PD High | 105.34 | 102.89 | ||

| 105.34 | cVPOC | 104.83 | 102.37 | ||

| 104.90 | VPOC | *BOLD indicates primary objectives | |||

| 104.37 | SETTLE | ||||

| 104.15 | PD Low | ||||

| 104.05 | LVN | ||||

| 103.63 | Fib Ext | ||||

| 103.11 | HVN | ||||

| 102.27 | LVN | ||||

Gold

From yesterday’s report, “There is an important LVN at 1270.50, which will serve as major support. If this level continues to hold firm, we could see a bounce back toward 1296.”

Gold continued its march lower Wednesday morning and came within 4 ticks of hitting my max target on the Short I took from 1287.40. Price eventually hit my stop to give me a 2 point gain on the full size. It seems the 1270.50 to 1272 zone was too good a value, and buyers stepped in and pushed price to a current overnight high of 1296.50. Like clockwork.

Gold has formed a great zone of support at 1286.8, which is currently the pivot to watch for the day. You’ll want to stay focused long above this level and buying pullbacks, or short below the pivot and selling pullbacks.

If price can push through 1296, we could see a push back toward 1305, which will be a win for the bulls to get price back over 1300. However, real strength won’t enter the market until 1320 is taken out. Below 1286.80 sees a potential retest of prior lows in the 1271s.

The current low of 1282 forecasts upside targets of 1294.50, 1300.70, and 1306.9, while the current high of 1296.50 suggests bear targets at 1284.10 and 1277.80.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: Gold (GCQ3) | |||||

| Thu, Aug 8, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 1,329.30 | nVPOC | ADR (10) | ONH | ONL | |

| 1,316.30 | LVN | 24.9 | 1,296.50 | 1,282.00 | |

| 1,312.20 | HVN | AWR (10) | WH | WL | |

| 1,311.70 | nVPOC | 55.30 | 1,320.30 | 1,271.80 | |

| 1,305.30 | nVPOC | ||||

| 1,300.90 | Monthly TC | DAILY TARGETS | WEEKLY TARGETS | ||

| 1,296.00 | LVN | BULL | BEAR | BULL | BEAR |

| 1,294.30 | Fib Ext | 1,313.13 | 1,284.05 | 1,327.10 | 1,278.83 |

| 1,293.30 | HVN | 1,306.90 | 1,277.83 | 1,313.28 | 1,265.00 |

| 1,289.00 | PD High | 1,300.68 | 1,271.60 | ||

| 1,289.00 | LVN | 1,294.45 | 1,265.38 | ||

| 1,285.80 | HVN | *BOLD indicates primary objectives | |||

| 1,284.10 | VPOC | ||||

| 1,284.70 | SETTLE | ||||

| 1,283.50 | cVPOC | ||||

| 1,275.10 | PD Low | ||||

| 1,275.00 | LVN | ||||

| 1,272.50 | LVN | ||||

| 1,269.80 | Fib Ext | ||||

| 1,260.00 | LVN | ||||

| 1,254.40 | HVN | ||||

Pingback: Tough Resistance Above 1700 | PivotBoss