PB View

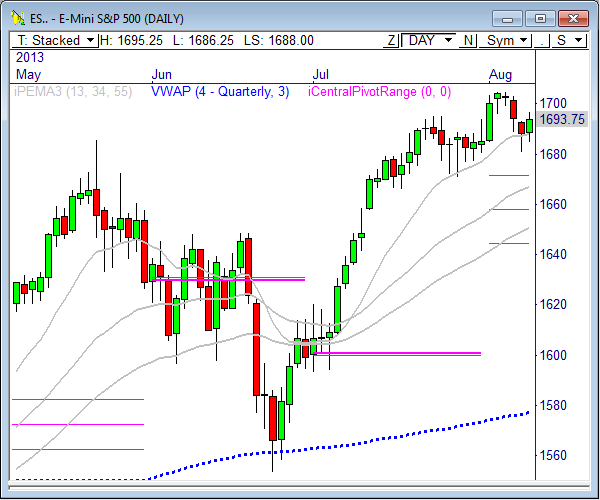

The market continues to be extremely bullish, with every dip being swiftly bought up by the bulls. In my opinion, the market is now nearing another decision point, as the S&P 500 futures continue to hold below the major resistance zone of 1700 to 1705. If prices push through this zone, we have a weekly target above 1707, but this is far from a certainty at this point, as the market continues to be shy around all-time highs. We could see a sideways to down effort if price is stifled at 1697.

Surprisingly, the market continues to build out within a very tight range from 1670 to 1705. Eventually, a breakout from this range will spark some nice trending behavior, so continue to watch it closely.

Cheers!

Frank Ochoa

PivotBoss | Own the Market

Follow me on Twitter: @PivotBoss

______________________________________________________

This daily report is currently free and open to the public, as I gather feedback and ideas ahead of a formal subscription offering later in the summer. If you have any feedback regarding anything in the report (good or bad) please provide it below in the comments section. Your comments will definitely help shape the report for the better. Thank you!

E-Mini S&P 500

From yesterday’s report, “If the bulls can convert the 1695 level, then 1707 is a great target to watch for the end of the week. If the bears maintain control of 1695, then a retest of 1690 may occur, which could pave the way for another test at the Wednesday lows.”

The E-Mini S&P 500 futures opened Thursday’s session with an early rejection of the 1695 level, which sent prices tumbling through 1690 before finally hitting a low of 1684.50. This low was bought up, and a steady rally ensued back toward the high of the day at 1697, where it finally closed the day quietly.

If prices can push through 1697 this morning, we could see a push into a high-confluence zone above between 1700 and 1702.50. If the market can push through this zone, which will be tough, we have a full range weekly target above at 1707.

If price continues to remain beneath the 1697 pivot, then we could see some potential chop between 1684 and 1697.

The current high of 1695.25 suggest bear targets at 1685.50, 1682.25, and 1679, while the pre-market low of 1686.25 suggests upside targets at 1696, 1699.25, and 1702.50.

Today’s scheduled economic news:

9:00am CT Wholesale Inventories m/m

Here are the Key Levels and Targets for the current session:

| PivotBoss Levels & Targets: E-Mini S&P 500 (ESU3) | |||||

| Fri, Aug 9, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 1,722.50 | Monthly R1 | ADR (10) | ONH | ONL | |

| 1,713.00 | Monthly H3 | 13.00 | 1,695.25 | 1,686.25 | |

| 1,705.00 | LVN | AWR (10) | WH | WL | |

| 1,702.50 | Open Gap | 26.50 | 1,705.00 | 1,680.50 | |

| 1,702.50 | nVPOC | ||||

| 1,701.75 | HVN | DAILY TARGETS | WEEKLY TARGETS | ||

| 1,697.00 | PD High | BULL | BEAR | BULL | BEAR |

| 1,696.25 | LVN | 1,702.50 | 1,688.75 | 1,707.00 | 1,685.13 |

| 1,695.25 | Monthly VAH | 1,699.25 | 1,685.50 | 1,700.38 | 1,678.50 |

| 1,695.25 | VPOC | 1,696.00 | 1,682.25 | ||

| 1,693.75 | SETTLE | 1,692.75 | 1,679.00 | ||

| 1,687.50 | 13PEMA | *BOLD indicates primary objectives | |||

| 1,684.50 | PD Low | ||||

| 1,683.50 | cVPOC | ||||

| 1,673.00 | LVN | ||||

| 1,670.00 | HVN | ||||

| 1,665.50 | LVN | ||||

| 1,661.00 | LVN | ||||

E-Mini NASDAQ 100

From yesterday’s report, “The pre-market trend has been strong, meaning that every pullback to value should be a buying opportunity as long as price remains above 3120, which is the key pivot for the session. There is a major zone of resistance between 3140 and 3141. Watch this zone closely.”

The E-Mini NASDAQ 100 sold off early in the session during Thursday’s RTH open and dropped through 3120 to find support at the day’s RTH pivot at 3108.50, which was hit with buys. Price then pushed higher the rest of the day before calling it quits 3 hours before the close.

The 15-minute chart shows price has formed a clear range from 3090 to 3140 and is currently holding near the upper portion of this range. It seems the NQ is a little hesitant in trying to test 3140, which is a major zone of resistance, and also includes a monthly pivot at 3141. If the market doesn’t want to give it a shot at 3140 early in the day, then price will likely auction lower to find buyers and then give it another shot later.

With double bottom lows at 3118 this morning, we could see buys begin to enter the market between 3122 and 3124, which could send prices into 3130 for another shot at prior highs. A violation through 3118 indicates more weakness down toward 3110 for another test at yesterday’s low.

The current overnight low of 3118 projects bull targets at 3131.75, 3138.50, and 3145.50, while the pre-market high of 3131.75 projects bear targets at 3118, 3111.25, and 3104.25.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: E-Mini NASDAQ 100 (NQU3) | |||||

| Fri, Aug 9, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 3,160.50 | Monthly R1 | ADR (10) | ONH | ONL | |

| 3,147.00 | Fib Ext | 27.5 | 3,131.75 | 3,118.00 | |

| 3,141.00 | Monthly H3 | AWR (10) | WH | WL | |

| 3,140.00 | LVN | 63.75 | 3,140.25 | 3,090.75 | |

| 3,136.50 | PD High | ||||

| 3,132.50 | VPOC | DAILY TARGETS | WEEKLY TARGETS | ||

| 3,132.25 | HVN | BULL | BEAR | BULL | BEAR |

| 3,129.50 | SETTLE | 3,152.38 | 3,118.00 | 3,154.50 | 3,092.44 |

| 3,124.00 | LVN | 3,145.50 | 3,111.13 | 3,138.56 | 3,076.50 |

| 3,110.00 | HVN | 3,138.63 | 3,104.25 | ||

| 3,108.50 | PD Low | 3,131.75 | 3,097.38 | ||

| 3,105.25 | LVN | *BOLD indicates primary objectives | |||

| 3,098.00 | Fib Ext | ||||

| 3,093.50 | 13PEMA | ||||

| 3,093.00 | HVN | ||||

| 3,090.00 | LVN | ||||

| 3,075.00 | HVN | ||||

| 3,069.50 | nVPOC | ||||

| 3,062.75 | LVN | ||||

| 3,034.00 | cVPOC | ||||

Crude Oil

From yesterday’s report, “At some point, we may see a big test between 103.23 and 103.48, which is a key zone in the daily timeframe that usually suggests a swing bounce…The current high of 104.96 forecasts bear targets at 103.41 and 102.89.”

Crude Oil had another wild day of trading Thursday, as prices tumbled through the 103.23 to 103.48 zone of support mentioned above, and dropped right into key targets at 103.41 and 102.89. As a matter of fact, CL dropped all the way to our 125% extended bear target of 102.37 and bottomed out at 102.22 before rallying big into the close.

The reversal from Wednesday’s low to the current pre-market high of 104.82 was big, but selling entered the market right off the high, which also coincided with the upper line of a downtrending channel. Clearly the 105 level remains a major line in the sand for CL, and a break through this level could spark another major swing move higher toward 105.75, followed by 106.83.

Keep an eye on short term support at the overnight low at 103.70. This level will dictate the early move in Crude, as a violation could send prices back toward 103.19.

The current overnight low of 103.70 projects bull targets at 104.79, 105.33, and 105.87, while the pre-market high of 104.82 suggests bear targets at 103.19 and 102.65.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: Crude Oil (CLU3) | |||||

| Fri, Aug 9, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 110.00 | Yearly R1 | ADR (10) | ONH | ONL | |

| 108.48 | LVN | 2.17 | 104.82 | 103.70 | |

| 108.00 | LVN | AWR (10) | WH | WL | |

| 107.59 | nVPOC | 4.54 | 107.69 | 102.22 | |

| 107.35 | LVN | ||||

| 106.83 | HVN | DAILY TARGETS | WEEKLY TARGETS | ||

| 105.96 | HVN | BULL | BEAR | BULL | BEAR |

| 105.75 | LVN | 106.41 | 103.74 | 106.76 | 104.29 |

| 105.34 | cVPOC | 105.87 | 103.19 | 105.63 | 103.15 |

| 104.89 | HVN | 105.33 | 102.65 | ||

| 104.05 | LVN | 104.79 | 102.11 | ||

| 103.71 | PD High | *BOLD indicates primary objectives | |||

| 103.40 | SETTLE | ||||

| 103.09 | HVN | ||||

| 102.64 | VPOC | ||||

| 102.25 | LVN | ||||

| 102.22 | PD Low | ||||

Gold

From yesterday’s report, “If price can push through 1296, we could see a push back toward 1305, which will be a win for the bulls to get price back over 1300. However, real strength won’t enter the market until 1320 is taken out…The current low of 1282 forecasts upside targets of 1294.50, 1300.70, and 1306.90.”

Gold has seen an incredible rally from the 1272 lows, where price formed a double bottom and rallied to highs of 1313.80 during Wednesday’s market. GC got a huge break through the 1296 level and rallied to each of the bull targets mentioned above. As a matter of fact, 1296 to the final bull target at 1306.90 means a gain of over $1000 per contract traded. Also, if you had looked at the extended bull target for Gold in the Key Levels matrix, you would have seen a final target at 1313.10, which was just 7 ticks from the high of the day.

The daily chart shows Gold is beginning to show signs of life from the recent lows and out of the monthly pivot range. I mentioned late last week that I thought Friday’s low would hold as the low for the month en route to a big move higher. Now that price has retested lows and reversed, I feel much better about price direction at this time, and believe we could still see much higher Gold prices by the end of the month.

The key pivot in the higher timeframe chart is 1296. If price remains above this level, we are likely to test 1320 above. A break through 1320 opens the door to a test at the next resistance level above at 1338.50. If Gold pulls back from current levels, look to buy a dip between 1296 and 1300. A retest of this zone should bring out the buyers ahead of the next wave of strength.

Short term, watch 1305. A break below this zone could spark a test of the 1296 to 1300 zone of support below. Beyond 1315 sees a test at 1320.

The current low of 1304.20 projects bulls targets at 1316.70, 1322.90, and 1329.20, while the current high of 1316.20 projects bear targets at 1303.70, 1297.40, and 1291.10.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: Gold (GCQ3) | |||||

| Fri, Aug 9, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 1,340.00 | HVN | ADR (10) | ONH | ONL | |

| 1,329.50 | HVN | 25.1 | 1,316.20 | 1,304.10 | |

| 1,329.30 | nVPOC | AWR (10) | WH | WL | |

| 1,316.30 | LVN | 55.30 | 1,320.30 | 1,271.80 | |

| 1,313.80 | PD High | ||||

| 1,312.20 | HVN | DAILY TARGETS | WEEKLY TARGETS | ||

| 1,309.90 | SETTLE | BULL | BEAR | BULL | BEAR |

| 1,309.90 | VPOC | 1,335.48 | 1,303.65 | 1,327.10 | 1,278.83 |

| 1,300.90 | Monthly TC | 1,329.20 | 1,297.38 | 1,313.28 | 1,265.00 |

| 1,296.30 | LVN | 1,322.93 | 1,291.10 | ||

| 1,291.70 | HVN | 1,316.65 | 1,284.83 | ||

| 1,288.00 | LVN | *BOLD indicates primary objectives | |||

| 1,287.70 | PD Low | ||||

| 1,285.80 | HVN | ||||

| 1,284.10 | nVPOC | ||||

| 1,283.60 | cVPOC | ||||

| 1,270.50 | LVN | ||||

| 1,260.00 | LVN | ||||

I like to know also if you will add the YM levels i mostly trade YM

thanks

Hi Leon! I will likely expand into new markets/products in the Fall, including the YM and FX futures contracts.

Frank