What a start to 2015!

Our analysis nailed the first full week of the year across several markets, from Crude Oil to the E-Mini NASDAQ 100 futures, and our Premium and 2-Week Trial Members loved it!

As a matter of fact, our Premium analysis nailed the week’s 260-point round trip move in the E-Mini NASDAQ 100 futures [CME: NQH15]!

As a matter of fact, our Premium analysis nailed the week’s 260-point round trip move in the E-Mini NASDAQ 100 futures [CME: NQH15]!

In case you missed it, here’s how we called the NQ the first week of the year, wherein we identify both key moves of the week, including forecasting targets for both directions with precision.

It’s really a thing of beauty, and it’s what sets apart PivotBoss analysis from the rest.

Here’s how it went down…

Day 1: Sunday, Jan 4, 2015

In our Sunday evening Premium Outlook video for the E-Mini NASDAQ 100 futures, I outlined the primary trade idea of the week for our Members, which includes the following analysis, along with a screenshot from the video analysis:

“Bears are currently in control of the short term trend, and will be looking to defend any pullbacks to the pivot range for a shot at new lows into 4146.50 and a shot at 4080.75.”

I accompany the analysis with a “playbook” drawing that gives traders an idea of how the upcoming price action could look, complete with targets:

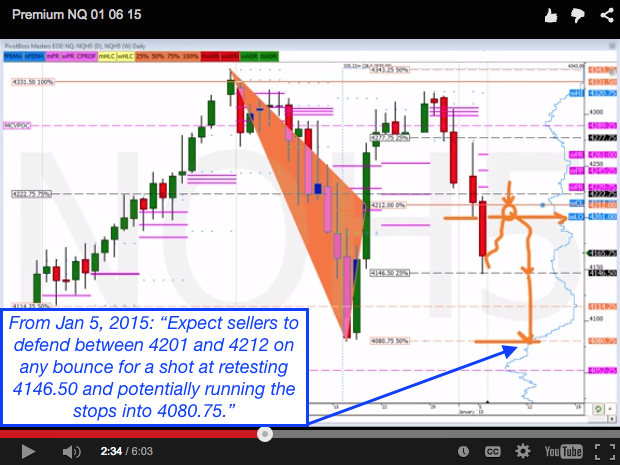

Day 2: Monday, Jan 5, 2015

The NQ sells off Monday and drops into our first forecasted downside target at 4146.50 for a quick 65-handle move. I update our Members of our current view, and offer additional guidance:

“Expect sellers to defend between 4201 and 4212 for a shot at retesting 4146.50 and potentially running the stops into 4080.75.”

Again, I provide an easy-to-understand playbook of potential price action to come, show in the screen capture below:

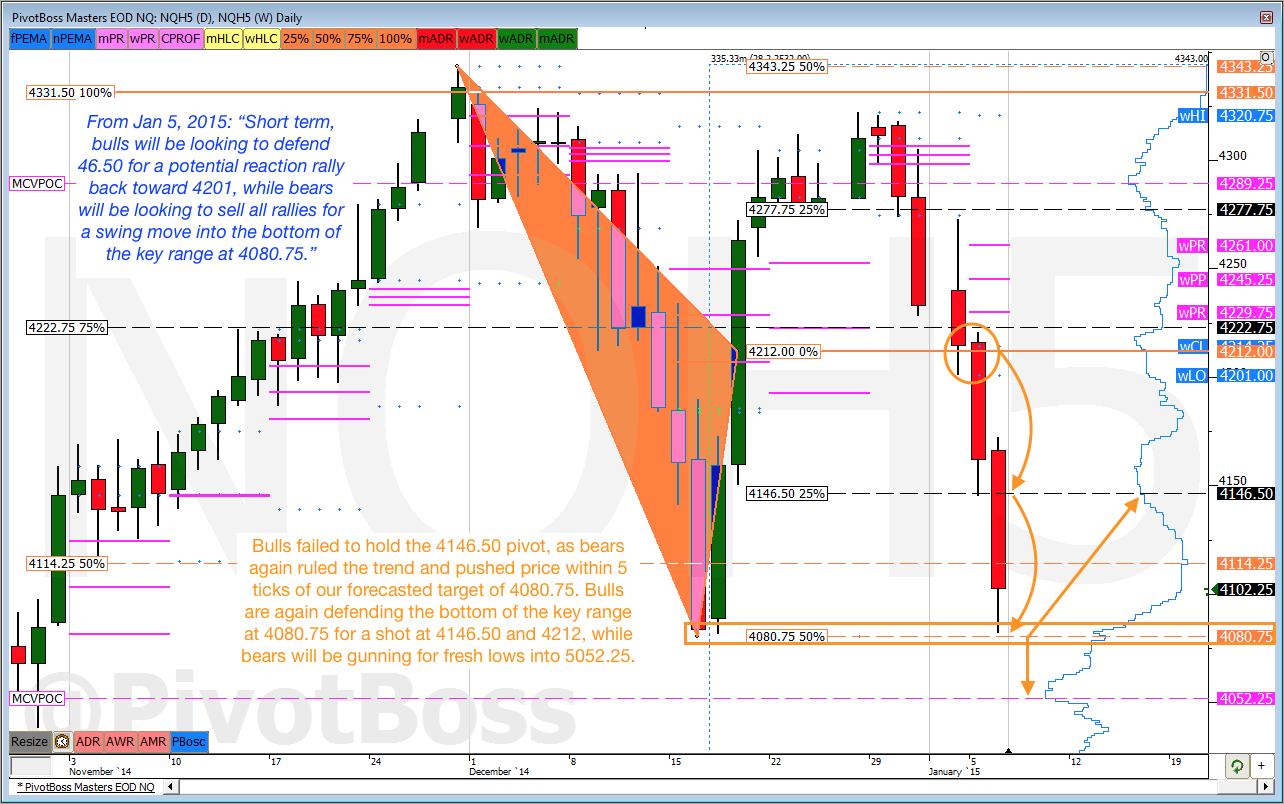

Day 3: Tuesday, Jan 6, 2015

The NQ continued lower during Tuesday’s session and came within 5 ticks of our second forecasted target of 4080.75 — capping a solid two-day sell-off of 130 points!

That’s $2600 of moves (per contract traded) in just two sessions…that’s tough to beat!

We again update our Members with fresh analysis, but this time include a buy opportunity for a shot at retesting the midpoint of the range at 4212.

Here’s the trade recommendation I provided, along with the corresponding EOD Playbook that Members received Tuesday afternoon:

“Bulls are again defending the bottom of the key range at 4080.75 for a shot at 4146.50 and 4212.”

Day 5: Thursday, Jan 6, 2015

By the end of Thursday’s session, the NQ had rallied back to the midpoint of the key range at 4212 from 4080.75 per our guidance — another 130-point trade recommendation!

$5200 in 4 Sessions

Our goal with Premium is to provide unmatched analysis and actionable trade recommendations to our Members on any given day.

Our swing analysis for the E-Mini NASDAQ 100 was on the money during the first week of the year, and helped identify a combined 260 points of moves for our Premium Members — in just four sessions! That’s a combined $5200 per contract traded!

Put another way, our 2-Week Trial Members paid under $10 for the first week’s access to Premium and received $5200 worth of recommendations in return.

And that was just for the NQ. Did you see this Crude Oil call?

Not yet a Member? Why not? Here’s your shot to give Premium a try for 2 Weeks!

Oh, and don’t forget, Day 3 of our Premium Boot Camp begins Tuesday afternoon…there’s still time to join!

Cheers!

Frank Ochoa

Author, Secrets of a Pivot Boss

PivotBoss | Own the Market

PivotBoss Premium | Premiere Analysis for Traders

PivotBoss Masters | Premiere Training for Traders

______________________

Start Your 2-Week Trial to Premium Today!