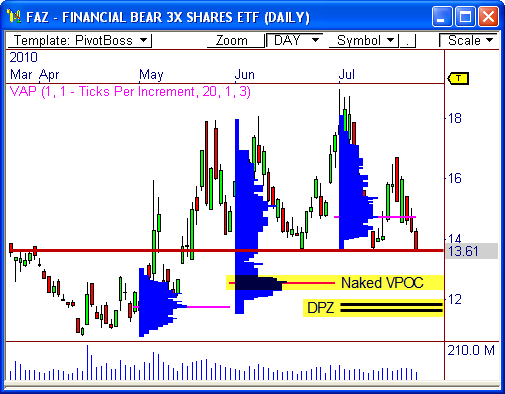

The Financial Bear 3X ETF ($FAZ) is sitting on a three-month critical support level at 13.60 and seems to be teetering on the brink of a break. A violation of this line could lead to another wave of selling pressure back toward $12, or lower.

Support at $13.60

The daily chart of $FAZ shows price has bounced off the $13.60 support level three times in the last three months and is now testing this level for the fourth time. The most recent test is occurring after the formation of a bearish lower high, which lends itself to a potential break of this support level.

Should a break occur, price could drop as low as $11.65…or at least $12.57. Here’s why…

Naked VPOC and Confluence of Support

The Volume at Price indicator shows the Volume Point of Control (VPOC) for the month of June is at $12.57. This level was not tested during its month of origin, thus making it a naked (or virgin) VPOC – which means the market will treat this level like a gap that must be filled. That is, eventually, the market will want to drop in order to “fill” this VPOC at $12.57.

If support is broken at $13.60, look for price to easily drop to $12.57 for the fill.

To learn more about the Volume at Price indicator, CLICK HERE.

If price continues to slide, however, we could see a move back toward a double pivot hot zone (DPZ) for the month of July, which spans from $11.65 to $11.87. This DPZ consists of the month’s L5 Cam level and S2 Floor Pivot level.

We’ll see what happens. But obviously, a break of support must first occur. However, if a break does occur, we have a pretty solid road map for where price might be headed.

Let’s see what happens!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss