With month number two of PivotBoss.com in the books, I wanted to share some of our best calls for the month of July – Greatest Hits Vol. 2! Again, thanks for your continued support through the initial launch of PivotBoss.com!

If you want to read the first Greatest Hits blog entry – CLICK HERE!

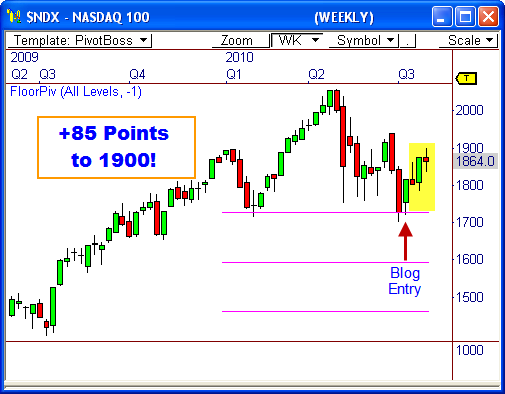

5. Thoughts on the $NDX

Last week, price formed a bullish candlestick, which shows that price had already begun to “snap back”. Given that this pattern formed at yearly support indicates that we could see an upside continuation back toward the 1,900 level.

4. Has the Russell 2000 Found Support?

If price can remain above the 590 level, we could see a steady bounce back toward the top of the channel at around 650 over the next 5 to 10 trading sessions.

3. 3 Reasons to Sell $ABX

The fact that price has also formed a bearish wick reversal signal (or Shooting Star) confirms weakness in this stock. Each of the bearish wick reversal signals that have fired in the last three months have led to 3 to 4 day declines in this issue. Therefore, we could see a nice swing short opportunity ahead.

As far as I can see, price can drop to anywhere from $40 to $38.50.

2. 3 Reasons to Watch the $SOX

The daily chart of the $SOX shows price is beginning to show early signs of strength off a well-defined support level at about $326.25.

Price has rallied three times from this support level over the last two months, with the moves ranging from $39 to $50 points.

1. This Metal is Ready to Move

The fact that the height of the pattern measures out to .5475, indicates a breakout could lead to a move that is equal to this measurement. Therefore, if an upside break occurs through 3.1, we could see a target back toward the April high at around 3.6475 – that’s a big move!

Let’s see what August has in store for us!

Cheers!

Frank Ochoa

PivotBoss.com

Follow Frank on Twitter: http://twitter.com/PivotBoss

Pingback: Tweets that mention PivotBoss.com's Greatest Hits Vol. 2 | PivotBoss.com -- Topsy.com