Jacobs Engineering Group, Inc. has enjoyed a nice four-month bull trend, and could be on the verge of another surge higher. Here’s more…

Confluence

The daily chart of JEC shows price has trended steadily higher the last four months, gaining 30% since the beginning of November. The recent pull-back from the 52-week high may prove to be a very nice swing buying opportunity.

As a matter of fact, the pull-back from recent highs led price to drop right into a solid source of support via 3-way confluence.

Tuesday’s trading activity led to the formation of a bullish reversal candlestick pattern that developed right at the monthly pivot range (pink lines), quarterly VWAP (blue dotted line), and within the trigger zone of “stacked & sloped” pivot-based moving averages (grey lines).

This trifecta of support could lead to a solid 3- to 5-day advance in the days ahead, and potentially more.

The Game Plan

Use the Retest Entry technique to trigger a Long position at $47.40 within the next day or two, using a 1/2 ADR stop at $46.80, and targets at 48.94, 49.13, and 49.85.

Keep in mind, if price breaks (and closes below) the monthly pivot range at 46.36, the trade is over, as it no longer satisfies the conditions of a pull-back swing trading opportunity.

Let’s see how this one plays out!

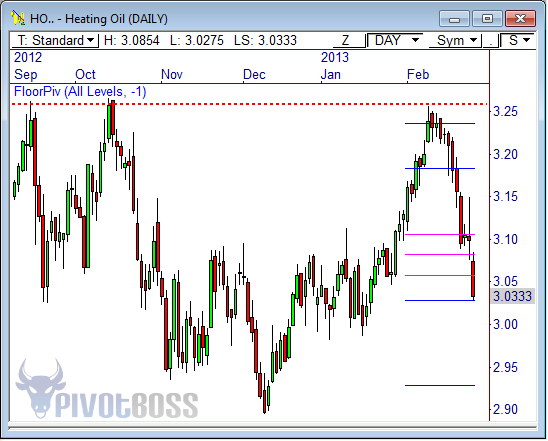

Heating Oil Update

In my last blog post, Heating Oil is One to Watch, I wrote about Heating Oil and its potential to move back toward 3.106. This target was reached in 6 days, and continues to push farther.

In just nine days, this trade has made 168% on margin. Beautiful.

FREE DVD

Don’t forget, if you buy my book Secrets of a Pivot Boss in February, you’ll also receive the Jumpstart Your Trading educational DVD – FREE!

Click here for details!

Cheers!

Frank Ochoa

PivotBoss | Own the Market

Follow us on Twitter: http://twitter.com/PivotBoss

Hi frank,

I have been following your trading ideas since alomost a year now. I find it quite insightful. I have also bought your ADR method DVD, with which i have seen satisfactory level of success. I have one request for you, – whenever you post a trade analysis/idea, please also post its update after some time, just as it was done in ” Heating Oil is one to watch”. so that the readers around the world can know that what to expect if similar setups/confluences/scenarios emerge anywhere in any trading instrument across any financial market. The update should have a conclusion i.e. exit @ profit, exit @ loss, partial exits or even stop loss triggered.

Once again thank you for your fantastic trading insights. May God bless you.

Thanks for the great feedback, Kashyap! I’ll be adding more “follow-ups” down the road, and will also be adding posts that “dissect” a particular trade, along with entries, exits, scales, etc.

Frank