PB View

It seems today may be the day that the S&P 500 futures will finally reach the round number milestone of 1700. Many traders have looked for this number to be reached since May, but it has taken a couple of months to get back within a stone’s throw.

While reaching 1700 seems like a foregone conclusion, I’m more interested to see how the market responds to this level after it is reached. Will the market automatically sell? Will the bulls push price way beyond 1700 to make a statement? Will price hang around 1700 for some time as bulls and bears jostle for position? The answers to each of these scenarios will give us a better understanding of how the market may play out in the days and weeks ahead.

Also, keep an eye on Gold. In one overnight session, Gold broke through the all-important 1300 zone and raced to 1320, which is the level we thought would be hit. Like the ES, how will Gold react to this zone ahead? A failure in this zone could spark another major sell-off ahead. Acceptance, however, could spark a decent recovery in this precious metal.

Cheers!

Frank Ochoa

PivotBoss | Own the Market

Follow me on Twitter: @PivotBoss

______________________________________________________

This daily report is currently free and open to the public, as I gather feedback and ideas ahead of a formal subscription offering later in the summer. If you have any feedback regarding anything in the report (good or bad) please provide it below in the comments section. Your comments will definitely help shape the report for the better. Thank you!

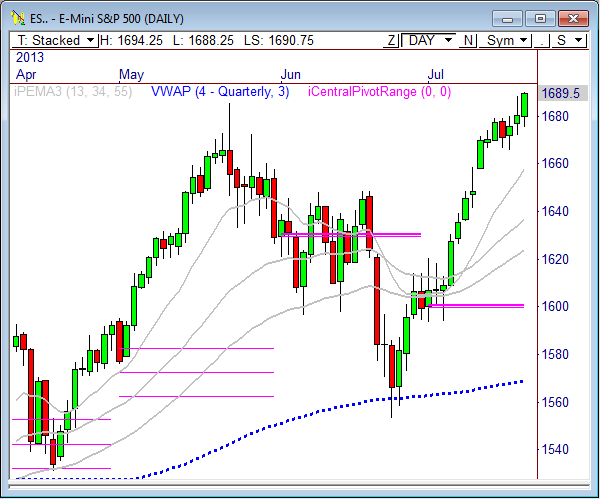

E-Mini S&P 500

In Friday’s ES report I wrote, “Longs should be cautious at these levels, but upside targets at 1686, 1689.50, and 1692.50 could be reached if the ES can get above 1684.50.”

The E-Mini S&P 500 traded rather quietly during Friday’s market, but generally traded higher throughout most of the session before rallying strong into the close, reaching key targets along the way. Friday’s late-day rip proved the bulls continue to maintain control, as price pushes toward 1700.

The key zone in the chart is 1678 to 1680. This is the level that separates the bulls and bears in the short term. If price remains above this zone, look for 1700 to be reached today, with primary targets at 1698.25 and 1701.75. An early dip between 1684.50 and 1686.25 could be a nice buy zone this morning.

Primary bear targets are 1687.50 and 1684.25, but selling will really pick up if the 1678-80 zone is taken out.

Today’s scheduled economic news:

9:00am CT Existing Home Sales

Here are the Key Levels and Targets for the current session:

| PivotBoss Levels & Targets: E-Mini S&P 500 (ESU3) | |||||

| Jul 22, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 1,708.25 | Monthly R2 | ADR (10) | ONH | ONL | |

| 1,697.75 | Monthly H5 | 13.5 | 1,694.25 | 1,688.25 | |

| 1,695.50 | Fib Ext | AWR (10) | WH | WL | |

| 1,690.50 | PD High | 43.00 | 1,690.00 | 1,690.00 | |

| 1,690.00 | SETTLE | ||||

| 1,688.50 | LVN | DAILY TARGETS | WEEKLY TARGETS | ||

| 1,682.75 | VPOC | BULL | BEAR | BULL | BEAR |

| 1,679.75 | LVN | 1,705.13 | 1,687.50 | 1,733.00 | 1,657.75 |

| 1,677.50 | PD Low | 1,701.75 | 1,684.13 | 1,722.25 | 1,647.00 |

| 1,677.25 | nVPOC | 1,698.38 | 1,680.75 | ||

| 1,673.00 | LVN | 1,695.00 | 1,677.38 | ||

| 1,672.50 | Fib Ext | *BOLD indicates primary objectives | |||

| 1,670.50 | nVPOC | ||||

| 1,670.00 | cVPOC | ||||

| 1,666.25 | LVN | ||||

| 1,664.25 | nVPOC | ||||

| 1,660.50 | LVN | ||||

| 1,656.00 | HVN | ||||

| 1,652.25 | LVN | ||||

| 1,648.75 | Open Gap | ||||

E-Mini NASDAQ 100

In Friday’s NQ report I wrote, “Be cautious if price rallies into the 3061 to 3066.75 zone. If price struggles here, this could be a prime selling opportunity, with downside targets at 3033.75, 3030.75, and 3026.25.”

The NASDAQ opened Friday’s market with early weakness and dropped right into the top end of our key zone of bear targets, bottoming out on the day at 3030.50. While the NQ chart looks quiet a bit more bearish than the other major market indexes, it held gap support nicely at 3025.50, which is going to be a big level this week.

If price can remain above 3025.50, we have a shot to retest prior support between 3061 and 3067. This is the zone that the NQ must recover in order to head higher. A failure in this zone could forecast a multiple-day move lower, especially if 3025.50 is broken.

Given Friday’s rather quiet range, we could see a decent start to the week once a breakout from Friday’s range occurs. Watch 3061.25 as the day’s primary bull target, and 3031.25 as the day’s primary bear target.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: E-Mini NASDAQ 100 (NQU3) | |||||

| Jul 22, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 3,096.00 | Monthly H5 | ADR (10) | ONH | ONL | |

| 3,087.00 | LVN | 28 | 3,052.25 | 3,040.25 | |

| 3,074.75 | cVPOC | AWR (10) | WH | WL | |

| 3,062.75 | LVN | 94.25 | 3,040.75 | 3,040.75 | |

| 3,056.00 | HVN | ||||

| 3,051.25 | Fib Ext | DAILY TARGETS | WEEKLY TARGETS | ||

| 3,046.50 | LVN | BULL | BEAR | BULL | BEAR |

| 3,045.50 | PD High | 3,075.25 | 3,038.25 | 3,135.00 | 2,970.06 |

| 3,044.00 | SETTLE | 3,068.25 | 3,031.25 | 3,111.44 | 2,946.50 |

| 3,039.75 | VPOC | 3,061.25 | 3,024.25 | ||

| 3,030.50 | PD Low | 3,054.25 | 3,017.25 | ||

| 3,029.50 | nVPOC | *BOLD indicates primary objectives | |||

| 3,026.25 | LVN | ||||

| 3,024.75 | Fib Ext | ||||

| 3,011.50 | HVN | ||||

| 3,008.00 | nVPOC | ||||

| 2,997.00 | Open Gap | ||||

| 2,995.00 | nVPOC | ||||

| 2,991.00 | HVN | ||||

Crude Oil

In Friday’s Crude report I wrote, “The 109.04 level has is a Fib extension from Thursday’s trading, so that level may offer resistance. Additionally, program trading algorithms are beginning to see a high number of Fib matches at these levels, which means we could see some selling in Crude at some point off these highs. Also, keep in mind my 109.51 weekly bull target is still above.”

Crude nearly reached last week’s primary bull target of 109.51, falling just 19 ticks shy of this lofty level, which is quiet impressive. After topping out at 109.32, August Crude sold off heavily back to 107.48 before settling the day at 107.93.

I’m now analyzing and trading September Crude, which has a current contract high of 108.93. As I mentioned in Friday’s report, Crude may begin to see some selling pressure off current highs, which has already begun to a certain extend. However, until 106.90 is taken out, further sideways-to-up movement is likely to occur.

Short term, watch the overnight support and resistance zones of 107.85 and 108.55 for early directional cues. A breakout from this range could spark the day’s primary move.

Keep in mind, Friday’s range was rather wide, which means we could see a digestion day today. If this is the case, watch 107.48 and 106.95 as the primary bear targets, and 108.94 and 109.46 as the primary bull targets.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: Crude Oil (CLU3) | |||||

| Jul 22, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 110.00 | Yearly R1 | ADR (10) | ONH | ONL | |

| 109.55 | Fib Ext | 2.11 | 108.53 | 107.88 | |

| 108.82 | PD High | AWR (10) | WH | WL | |

| 108.32 | LVN | 5.90 | 107.87 | 107.87 | |

| 107.93 | SETTLE | ||||

| 107.71 | Monthly R3 | DAILY TARGETS | WEEKLY TARGETS | ||

| 107.60 | cVPOC | BULL | BEAR | BULL | BEAR |

| 107.34 | VPOC | 110.52 | 107.48 | 113.77 | 103.45 |

| 106.91 | PD Low | 109.99 | 106.95 | 112.30 | 101.97 |

| 106.69 | LVN | 109.46 | 106.42 | ||

| 106.18 | Fix Ext | 108.94 | 105.89 | ||

| 106.05 | LVN | *BOLD indicates primary objectives | |||

| 105.97 | nVPOC | ||||

| 105.74 | HVN | ||||

| 105.33 | LVN | ||||

| 104.37 | LVN | ||||

| 104.20 | LVN | ||||

| 103.52 | Open Gap | ||||

Gold

In Friday’s Gold report I wrote, “There remains a confluence of resistance between 1300 to 1302, so any push into this zone could be sold on first test. However, a violation of this zone could lead to a big wave of strength back toward 1320 in a flash.”

Well, it happened. Gold got a major break through 1,300, and it happened in a flash just after trading opened for the week Sunday night. Gold rallied to 1319.3 in mere minutes, and then pulled back for another wave of strength to 1325, which is currently the high of the day.

As I mentioned before, I thought that if GC was to head lower, it must first test higher. If the upside test fails, then the market has the information it needs to seek lower prices. However, if Gold begins to find acceptance above 1300, we could see a further probe into 1360 above.

Given the overnight burst of strength, Gold has already reached the day’s 125% bull target at 1324.10. The 1330 level is the next highest bull target for the day. Look to buy pullbacks today as long as price remains above 1319. A break below this level could spark a move to overnight support at 1313. A violation of 1313 opens the door for a retest at 1300.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: Gold (GCQ3) | |||||

| Jul 22, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 1,357.80 | Monthly H4 | ADR (10) | ONH | ONL | |

| 1,348.00 | 55PEMA | 23 | 1,325.00 | 1,295.40 | |

| 1,335.30 | Fib Ext | AWR (10) | WH | WL | |

| 1,316.50 | Fib Ext | 60.20 | 1,292.90 | 1,292.90 | |

| 1,309.60 | 34PEMA | ||||

| 1,301.30 | Monthly TC | DAILY TARGETS | WEEKLY TARGETS | ||

| 1,297.10 | PD High | BULL | BEAR | BULL | BEAR |

| 1,297.00 | LVN | 1,324.15 | 1,313.50 | 1,353.10 | 1,247.75 |

| 1,292.80 | SETTLE | 1,318.40 | 1,307.75 | 1,338.05 | 1,232.70 |

| 1,292.70 | VPOC | 1,312.65 | 1,302.00 | ||

| 1,291.10 | Monthly H3 | 1,306.90 | 1,296.25 | ||

| 1,288.10 | LVN | *BOLD indicates primary objectives | |||

| 1,287.90 | PD Low | ||||

| 1,284.40 | Fib Ext | ||||

| 1,283.80 | cVPOC | ||||

| 1,275.80 | Monthly Pivot | ||||

| 1,275.20 | LVN | ||||

| 1,269.50 | LVN | ||||

| 1,260.80 | LVN | ||||

Pingback: Is Today the Day? | PivotBoss

Pingback: Still Waiting on 1700 | PivotBoss