PB View

Another day, and more of the same. The S&P 500 remains allergic to 1700, while Gold and Crude continue to have wild price swings, which have been great for both day and swing traders.

The daily chart of the ES shows price closed back below the 3rd standard deviation of the year-to-day VWAP Bands indicator. This extreme push out of the bands, and the close back within them, suggests a reversion to mean trade is likely ahead. If price remains beneath the short term fulcrum of 1686, we could see a push back toward an area of confluence at 1650, which holds the monthly VWAP and the YTD 2nd standard deviation band. Of course, there will be support at 1666.50, which is the next key zone to be tested below.

Overall, the market remains quiet bullish, but exhaustion has become apparent in the short term. Keep an eye on 1650 for swing buys down the road.

Cheers!

Frank Ochoa

PivotBoss | Own the Market

Follow me on Twitter: @PivotBoss

______________________________________________________

This daily report is currently free and open to the public, as I gather feedback and ideas ahead of a formal subscription offering later in the summer. If you have any feedback regarding anything in the report (good or bad) please provide it below in the comments section. Your comments will definitely help shape the report for the better. Thank you!

E-Mini S&P 500

In yesterday’s ES report I wrote, “Watch 1691.50 as the early pivot. A pullback to this level could be bought on first test, while a violation could lead to another key test at 1686…If a retracement occurs soon, a move to 1666.50 seems likely, with the potential to see another test of 1650.”

The E-Mini S&P 500 futures have had a heck of a time trying to get beyond the 1694 to 1695.50 zone, and that was the case again Wednesday morning, as prices topped out at 1695.50 before breaking below the 1691.50 level en route to a break of 1686. The ES eventually bottomed out at 1677.25, which puts the 1666.50 level in plain view the next day or two.

By far, Wednesday’s trading was one of the most unidirectional bear moves we’ve seen in a while, and the inability to claim the 1700 level (again!) indicates the market is indeed become exhausted in the near term.

Short term, watch 1678 and 1675 for early directional cues this morning. As long as the ES remains beneath 1686, we’re likely to see price push lower toward 1666.50. An upside push through 1678 would forecast short term strength toward 1684.50 to 1686, but buying may be capped at the top end of this range.

The primary weekly bull target is 1704, but the ES has definitely had trouble rising to this zone, so keep an eye on the primary bear target for the week at 1663.25.

Today’s scheduled economic news:

7:30am CT Core Durable Goods Orders m/m

7:30am CT Unemployment Claims

7:30am CT Durable Goods Orders m/m

7:45am CT Treasury Sec Lew Speaks

9:30am CT Natural Gas Storage

Here are the Key Levels and Targets for the current session:

| PivotBoss Levels & Targets: E-Mini S&P 500 (ESU3) | |||||

| Jul 25, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 1,708.25 | Monthly R2 | ADR (10) | ONH | ONL | |

| 1,701.00 | Fib Ext | 12.75 | 1,684.25 | 1,671.75 | |

| 1,697.75 | Monthly H5 | AWR (10) | WH | WL | |

| 1,694.50 | PD High | 43.00 | 1,695.50 | 1,671.75 | |

| 1,693.00 | LVN | ||||

| 1,683.75 | SETTLE | DAILY TARGETS | WEEKLY TARGETS | ||

| 1,682.00 | LVN | BULL | BEAR | BULL | BEAR |

| 1,680.75 | VPOC | 1,687.69 | 1,677.88 | 1,714.75 | 1,663.25 |

| 1,677.50 | cVPOC | 1,684.50 | 1,674.69 | 1,704.00 | 1,652.50 |

| 1,677.25 | PD Low | 1,681.31 | 1,671.50 | ||

| 1,673.00 | LVN | 1,678.13 | 1,668.31 | ||

| 1,670.75 | Fib Ext | *BOLD indicates primary objectives | |||

| 1,670.50 | nVPOC | ||||

| 1,670.00 | HVN | ||||

| 1,666.25 | LVN | ||||

| 1,664.25 | nVPOC | ||||

| 1,662.00 | LVN | ||||

| 1,656.00 | HVN | ||||

| 1,652.25 | LVN | ||||

| 1,648.75 | Open Gap | ||||

E-Mini NASDAQ 100

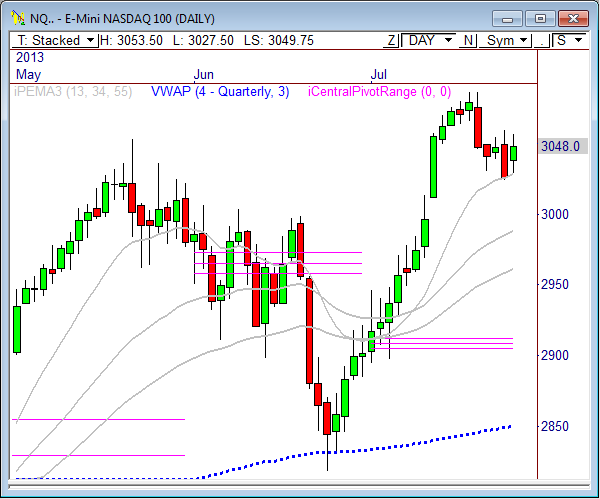

In yesterday’s NQ report I wrote, “The 3055 zone will remain important today…If price cannot hold above 3055, then another move to 3043 and 3035 could be seen.”

The NASDAQ opened Wednesday’s session with an early test of 3055, but failed at this level, which paved the way to tests at 3043 and 3035 before reaching a low on the day at 2028.75.

The NQ got an impressive late-day reversal and eventually closed the day at 3049.50, but formed an Inside Day pattern, which lead to a breakout during Wednesday’s trading. Watch the boundaries of Wednesday’s range for a violation, as a breakout could spark a decent move.

We’ve seen big weakness, followed by strength during pre-market trading already this morning, but the NQ remains within the boundaries of yesterday’s range, which spans from 3028.75 to 3057.25.

Use 3060 to 3065 as the dividing line between bulls and bears. Short term weakness should be seen, as long as the NQ remains beneath this zone. If the bulls can reclaim this zone, however, we could see a retest of prior highs.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: E-Mini NASDAQ 100 (NQU3) | |||||

| Jul 25, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 3,096.00 | Monthly H5 | ADR (10) | ONH | ONL | |

| 3,086.00 | LVN | 26 | 3,053.50 | 3,027.50 | |

| 3,074.75 | HVN | AWR (10) | WH | WL | |

| 3,074.50 | nVPOC | 94.25 | 3,060.00 | 3,027.50 | |

| 3,068.00 | Fib Ext | ||||

| 3,062.75 | LVN | DAILY TARGETS | WEEKLY TARGETS | ||

| 3,057.25 | PD High | BULL | BEAR | BULL | BEAR |

| 3,049.50 | SETTLE | 3,060.00 | 3,040.50 | 3,121.75 | 2,989.31 |

| 3,046.00 | LVN | 3,053.50 | 3,034.00 | 3,098.19 | 2,965.75 |

| 3,034.00 | VPOC/cVPOC | 3,047.00 | 3,027.50 | ||

| 3,028.75 | PD Low | 3,040.50 | 3,021.00 | ||

| 3,027.50 | LVN | *BOLD indicates primary objectives | |||

| 3,018.00 | Fib Ext | ||||

| 3,008.00 | nVPOC | ||||

| 2,997.00 | Open Gap | ||||

| 2,995.00 | nVPOC | ||||

| 2,991.00 | HVN | ||||

Crude Oil

In yesterday’s Crude report I wrote, “Short term, watch the 106.90 level, which has become a level of interest over the last few session. Today’s primary bull target is 108.23, and the primary bear target is 105.95.”

If all you had to know was one level for Wednesday’s trading in Crude, it was 106.90, which delivered a huge 2-point move when price failed at this zone early in the session. That’s $2,000 per contract traded in a matter of 3 hours, which is tough to be beat.

Crude Oil has yet to recover after yesterday’s decline, and is currently trading within a downtrending channel in pre-market trading. The key short term pivot for CL is 105.00 this morning. If price remains beneath this zone, we’re likely to see a retest of major support down below at 104.20, which is a zone the bulls must hold if they want to gain momentum toward 110.

If 104.20 gives way, we could be looking at another quick drop back toward 103, and then 101. Keep in mind, however, that Crude remains very bullish overall. Any retracement of that magnitude could be a swing buy opportunity for another shot at new highs, as the Yearly R1 Floor Pivot is still above at 110, ready to be tested.

Given the current pre-market range, use 105.92 as the primary bull target, and 103.86 as the primary bear target.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: Crude Oil (CLU3) | |||||

| Jul 25, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 110.00 | Yearly R1 | ADR (10) | ONH | ONL | |

| 108.32 | LVN | 2.11 | 105.44 | 104.34 | |

| 107.77 | Fib Ext | AWR (10) | WH | WL | |

| 107.71 | Monthly R3 | 5.90 | 108.79 | 104.42 | |

| 106.95 | PD High | ||||

| 106.40 | LVN | DAILY TARGETS | WEEKLY TARGETS | ||

| 105.90 | cVPOC | BULL | BEAR | BULL | BEAR |

| 105.44 | SETTLE | 106.98 | 104.39 | 110.32 | 104.37 |

| 105.24 | VPOC | 106.45 | 103.86 | 108.85 | 102.89 |

| 104.79 | PD Low | 105.92 | 103.33 | ||

| 104.69 | LVN | 105.40 | 102.80 | ||

| 104.37 | LVN | *BOLD indicates primary objectives | |||

| 104.20 | LVN | ||||

| 103.97 | Fib Ext | ||||

| 103.73 | LVN | ||||

| 103.52 | Open Gap | ||||

| 103.00 | HVN | ||||

Gold

In yesterday’s Gold report I wrote, “For Wednesday’s market, watch the narrow range that has formed from 1338 to 1345…A downside break through 1338 would introduce 1333.60, 1331.4, 1330.2, and 1325.”

Gold broke the morning’s narrow range to the downside at 1338 and reached each of the four targets mentioned above, producing a move worth $1300 per contract traded by the time price reached 1325. But that wasn’t all, price continued even lower after breaking 1325 and eventually bottomed out at 1312.70 for a move worth over $2500 per contract traded. By the way, current margin to trade one contract is $5,600, so yesterday’s one-day move was worth about 45% on your money.

For Thursday’s session, the 1330 level seems to be the key fulcrum in the chart. If price remains beneath this zone we could see another test of pre-market lows in the 1308.40 to 1310 zone, which by the way is a zone that offers big time confluence, thus the big bounce that occurred there this morning. This zone is the area that the bulls must defend, while the bears want to keep a lid on 1348.

If price cannot rise beyond 1330 today, look for downside targets to be reached at 1315.50 and 1309. Above 1330 forecasts 1334.4 and 1337.80.

Here are the targets for the current session and the week ahead:

| PivotBoss Levels & Targets: Gold (GCQ3) | |||||

| Jul 25, 2013 | |||||

| KEY LEVELS | ADR TARGETS | ||||

| 1,385.50 | cVPOC | ADR (10) | ONH | ONL | |

| 1,371.40 | Monthly R1 | 26 | 1,328.50 | 1,308.40 | |

| 1,357.80 | Monthly H4 | AWR (10) | WH | WL | |

| 1,350.40 | Fib Ext | 60.20 | 1,348.70 | 1,295.40 | |

| 1,346.30 | 55PEMA | ||||

| 1,345.20 | LVN | DAILY TARGETS | WEEKLY TARGETS | ||

| 1,341.20 | PD High | BULL | BEAR | BULL | BEAR |

| 1,338.00 | LVN | 1,340.90 | 1,315.50 | 1,355.60 | 1,303.55 |

| 1,335.40 | VPOC | 1,334.40 | 1,309.00 | 1,340.55 | 1,288.50 |

| 1,333.60 | HVN | 1,327.90 | 1,302.50 | ||

| 1,325.80 | LVN | 1,321.40 | 1,296.00 | ||

| 1,318.90 | SETTLE | *BOLD indicates primary objectives | |||

| 1,318.00 | LVN | ||||

| 1,317.00 | PD Low | ||||

| 1,312.70 | 34PEMA | ||||

| 1,310.00 | LVN | ||||

| 1,309.00 | 50% Fib | ||||

| 1,307.80 | Fib Ext | ||||

| 1,301.30 | Monthly TC | ||||

| 1,299.00 | LVN/62% Fib | ||||

| 1,292.70 | nVPOC | ||||

| 1,288.10 | LVN | ||||

| 1,283.80 | HVN | ||||

Pingback: Coiling for a Breakout in NQ | PivotBoss